Credit card defaults on the rise. Is it time to ring the alarm?

While it is easy to obtain and recklessly use a credit card, it is just as easy to spiral into an endless debt trap. Moreover, India has one of the highest APRs and penal charges in the world, at about 48%.

- Ira Puranik

- Last Updated : August 9, 2023, 19:37 IST

The number of credit card holders in India is on a meteoric rise and so is the rate of defaults. According to data presented in Lok Sabha on Tuesday, defaults on credit cards rose to a staggering Rs 4,072 crore in FY23.

This is a 1.9% Y-o-Y rise from Rs 3,122 crores, which was the figure in March 2022. Around Rs 2.10 lakh crore was outstanding in balances on credit cards till March 2023.

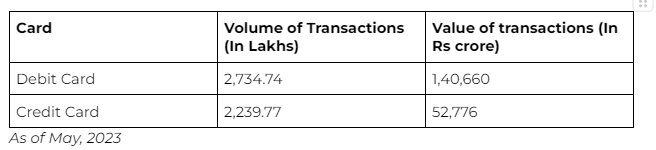

The exponential rise in the figures is a direct result of the jump in the number of credit cards, which stood at Rs 10,616 lakhs in May 2023, as per RBIs July bulletin. In contrast, debit cards were a mere 877.4 lakhs during the same period. Credit cards have seriously caught the fancy of Indians, outpacing debit cards by a far margin in terms of volume and value of transactions.

This comes at a time when credit card usage is rapidly escalating all over the world. A recent report by the Fed noted that USAs credit card balances jumped from $45 billion to over a trillion dollars in the second quarter of 2023. However, what is concerning is that India’s exposure to unsecured debt like credit cards is far higher.

This is also why the apex bank has time and again, issued caution to banks to keep a check on their credit card disbursal.

Maintaining a good credit utilization ratio

But it’s not just the banks who need the refrain, but us. While it is easy to obtain and recklessly use a credit card, it is just as easy to spiral into an endless debt trap, thanks to this. Moreover, India has one of the highest APRs and penal charges in the world, at about 48%. APR, or annual percentage rate is the amount you pay annually to borrow funds.

However, prevention is better than cure. While judicious spending through your credit cards, availing offers and cashbacks is a good thing, you should keep your CUR, or credit utilization ratio.

CUR indicates the amount of outstanding/payable balance you have on your credit cards at any given point of time. Ideally, this should be around 30% or less. A higher CUR can have adverse impact on your credit score and invite high interest and penalties.

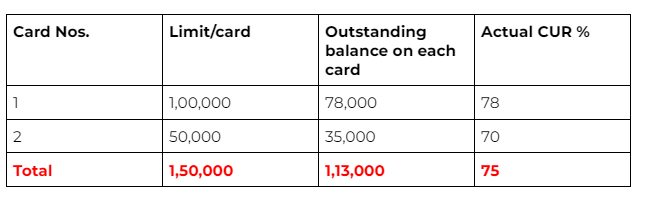

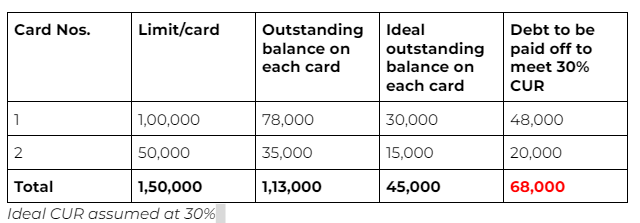

Say Aarav has two credit cards, on which the limits are as follows :

Clearly, Aarav is not managing his credit effectively, since his revolving or outstanding credit is more than two times the ideal limit of 30%. To bring down his CUR, he needs to immediately pay off Rs 68,000.

Says CFP Nisreen Mamaji, “It is always advisable to pay your credit card bills and loans on time to keep your credit score high. When times are tough, if you at all need to take a loan, creditors should be more than happy to lend you a loan. Moreover, If you make it a habit to live within your means and not rely heavily on credit, you are less likely to go into a debt trap.”

Download Money9 App for the latest updates on Personal Finance.

Related

- Budget’24: New LTCG rule to hit long-term property owners hard

- Health insurance vs. Medical corpus: What’s your choice?

- The Hidden Costs of Refinancing Home Loans

- Can Homebuyers Expect Tax Rebate from Budget’24?

- Use credit card a lot? Here are 5 ways to avoid debt traps!

- YEIDA launches 361 plots for sale near Noida airport