Home loan rates at a fresh low, should you go for it?

A 5-basis point cut in the interest rate for a home loan of Rs 10 lakh of 20 years brings down the cost of the loan by Rs 7,113 and EMI by Rs 30.

If you are planning to buy a house, this might be a good time for you as India’s top lenders including State Bank of India (SBI), Kotak Mahindra Bank, HDFC Ltd, Punjab National Bank have reduced the interest rate on home loans. Besides this, they are also offering various deals including discounts on processing fees or special benefits for women buyers.

Adhil Shetty, CEO, BankBazaar.com, said, “Interest rates are at a historic low. This is coupled with continuing PMAY benefits, choice inventory, and slashed registration costs in some places. If you can afford to buy a home for self-occupation, then there is no time like now.”

“Banks are also looking to boost their lending portfolio. Historically, the last quarter of the financial year is when maximum investments in assets such as homes are closed. As a result, lenders come out with attractive schemes around loan products this time of the year to draw more customers. SBI has been the first to announce the rate cut. We can look forward to more banks coming out with such offers,” added Shetty

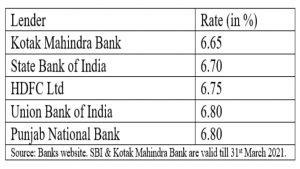

Rate check

Here are the cheapest home loan rates offered across lenders

These rates are for new borrowers and not applicable to existing borrowers.

Rate cut gains

A rate cut brings down the cost of a loan. For instance, if someone has availed a home loan of Rs 10 lakh at 7% for 20 years. The equated monthly installment (EMI) would come to Rs 7,753/- and the cost of the loan would be Rs 8.60 lakh over the loan tenure. Now if we calculate EMI and cost of the loan for the same loan amount and tenure for reduced interest rate say 6.65%. The EMI comes down by Rs 209 to Rs 7,544, while the cost of the loan works out at Rs 8.10 lakh, a savings of Rs 50,000. Well, those savings can be used in buying some white goods or furniture for your new home.

A 5-basis point cut in the interest rate for a home loan of Rs 10 lakh of 20 years brings down the cost of the loan by Rs 7,113 and EMI by Rs 30.

Does shifting make sense?

While the attractive home loan rates are only for new customers. So, does it make sense to transfer your existing home loan at new interest rates? Well for that, one needs to take into consideration various costs like stamp duty, processing fees, foreclosure charges and so on and work out the savings. Many experts believe that balance transfer makes economic sense only when the rate differential is 50 basis points or higher, and the tenure is more than 10 years.

“Transferring home loan makes sense for people who had availed a home loan in pre-COVID-19 times and have a home loan rate of say 8 or 8.5%. Also, people whose loans were rejected by top lenders due to low credit scores but availed a home loan at higher rates can look at transferring. As over the year due to repayment of loans their credit score would have improved and can now apply with top lenders and take benefit of prevailing low-interest rates,” said Atul Monga, Co-founder and CEO, Basic Home Loan.

Download Money9 App for the latest updates on Personal Finance.

Related

- Budget’24: New LTCG rule to hit long-term property owners hard

- Health insurance vs. Medical corpus: What’s your choice?

- The Hidden Costs of Refinancing Home Loans

- Can Homebuyers Expect Tax Rebate from Budget’24?

- Use credit card a lot? Here are 5 ways to avoid debt traps!

- YEIDA launches 361 plots for sale near Noida airport