Home Loan: Should you prepay or invest the surplus in other instruments?

If an investor has a surplus amount and wishes to explore other investment options, such investment must provide a return of least 10-12% in order to be profitable

Buying a house is a costly affair, which usually compels most individuals to take a loan. From the investment point of view, real estate is always considered as last resort because of heavy interest outflow. However, for investor who believe heavily on pros of buying a property or consider it as a necessity more than an investment, have majority of their earnings locked in payment of housing loan EMIs. Therefore considering the fact and a certain eventuality of steady income rise, investors often come across a common dilemma with regards to the excess income whether to make principle repayment of home loan or to invest the money in other avenues?

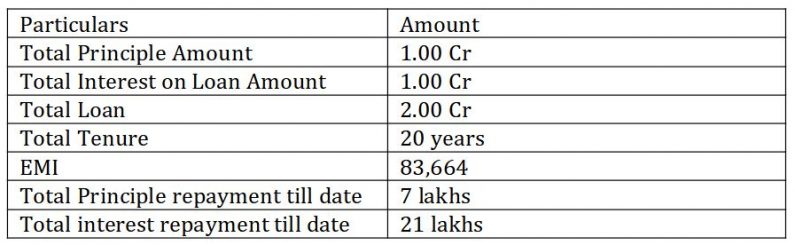

To begin with, let us take an example of Aakash who came to Pune for studies and later on got settled in the city with premium job. Three years ago after his marriage Aaskash bought a 3BHK flat in Pune and is paying around Rs 83,000 as EMI for the same. During these three years Aakash was fortunate to receive healthy increments and now is across the above mentioned dilemma. The below table explains us the view in more precise manner.

Now considering Aakash wants to repay the home loan, one way to do it is by increasing the EMI and reducing the tenure. Therefore from remaining 17 years of tenure, if Aakash considers to reduce its tenure by 7 years (17 – 7) = 10 years (new tenure), his EMI will rise from 83664 to 1.12 lakhs per month. Let us check the new calculation.

Note on savings – Total outstanding loan 1.70 Cr (2.01Cr. -30 lakhs) – New Total loan 1.35 Cr = 35 lakhs – loss on tax

So here we say by increase in around 40,000 (1.12 lakhs new EMI – 83K old EMI) in EMI Aakash can save about 25 lakhs. Now let us consider if Aakash invest the same 40K in SIP instead of increasing his EMI.

Therefore in 17 years Aakash instead of increasing his EMI if invests in SIP saves around 1.65 Crores net. So we have a clear answer, for the much discussed dilemma. However the equation does not answer all the questions like:

1. Immediate need of funds: Marriage, emergency fund, unwarranted medical expenditure etc. such things may bring up a sudden fund requirement and deter any prepayment of loan. During the ongoing pandemic, emergency fund has become an utmost necessity, therefore it mandatory to give preference to such expenditure before you decide on the dilemma.

2. Uncertainties: Good times might come to an abrupt end, like in ongoing pandemic where jobs and business have been affected worldwide, prepayment of loan in such times might bring you in tough spot by hampering your liquidity considerably. In addition to that earlier 6 months expenditure was the ideal emergency fund, which now been raised by advisors to 12 months. Currently the whole world is unaware of when the current pandemic will end, thus it is very much risky to make a prepayment without giving due regards to income source uncertainties.

3. Tax benefit: Not that investors buy house in order to save tax, however its importance cannot be undermined especially when the savings under section 80C (Tax deductions on the principal repayment), Section 24 (Tax deductions on the interest amount payable) & Section 80EE (Additional home loan interest tax benefit for first-time home buyers) amounts up to Rs. 4 lakhs per year in aggregate. Thus if you close your loan early, you’re foregoing this benefit and increasing your tax liability.

4. Other investment avenues carry risk: Investment in a SIP for better returns seems like a straight forward option, however the returns are not guaranteed. SIPs possess inherent risk of market volatility and economic conditions; therefore any investment is subject to such risk. In addition to that the calculation might also vary and might jeopardize the entire savings chunk. However going by the history, Sensex has provided around 15% annualized return on equity instruments in last 4 decades. Therefore it is not completely blind shooting to calculate such generous return, albeit the risk involved should not be overlooked.

5. Psychological pressure: Investors from low- or middle-income group are often opined to close loans as early as possible. Loans are always termed to be burden and families or older generation always pressure their family members to repay them sooner rather than later. Loan in general sense should be taken to uplift your living or to fulfill a necessity, whereas majority investors irrespective of the ultimate objective, believe in its repayment as and when possible, but do not think of alternative investment avenues.

6. Low risk options are futile: Housing loan being the cheapest loans amongst its peers, where the interest cost ranges in between 7-9% per annum on a floating basis. Therefore when investors arrive at surplus amount and wishes to explore other investment options, such investment must provide a return of least 10-12% in order to be profitable. All the secured or low risk investment options provide mere 6-8% annualized return which makes it futile to invest in such instruments. The only remaining option, the investors are left is with equity market via SIP route or direct investment. The reason being history has been favorable with equity market in terms of average 12% annualized return. However such equity market comes with higher risk and in addition to that the returns are not guaranteed, making it difficult for risk averse investors to explore this option.

To conclude, if an investor comes across the dilemma of either to prepay the loan or to invest in other avenues, he or she should take the decision owing to factors such as investor’s age, risk appetite, emergency fund status, job or income security and immediate fund requirement. If you can tackle those question, the answer will be self-explanatory.