Personal loans: A look at what the top-10 banks are offering

A personal loan is a short to medium-term loan that bridges the funding requirement that enables you to meet unexpected expenses

Unexpected expenses can always come at the most inopportune moments and your savings kitty may not be sufficient to meet those unexpected needs. So, if you are the one who needs a particular amount but falling short of the funds? Then getting a personal loan would solve your problem.

A personal loan can bridge the funding requirement and enables you to meet unexpected expenses. Generally, people take a personal loan for wedding expenses, medical emergencies, home furnishing requirements or vacation.

A personal loan is an unsecured loan that generally higher rate of interest than a home loan or car loan. Hence, you need to know your finances well in advance before you opt for one.

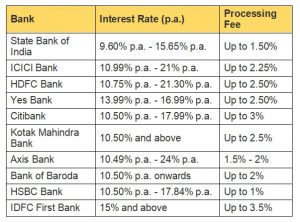

Here’s a look at what banks are offering:

Source: BankBazaar.com

Note: The above rates have been updated on March 25, 2021. Additional GST will be charged on the applicable processing fee.

EMI

The Equated Monthly Instalment (or EMI) is the principal portion of the loan amount and the interest. Therefore, EMI = principal amount + interest paid on the personal loan. The EMI, usually, remains fixed for the entire tenure of your loan, and it is to be repaid over the tenure of the loan on a monthly basis.

So, if you are applying for a personal loan, amounting to Rs 2,00,000 at a rate of interest of 15.5% p.a. and your loan tenure is 2 years, your EMI will be calculated using the following formula:

P x R x (1+R)^N / [(1+R)^N-1] where P = Principal amount of the loan, R = Rate of interest and N = Number of monthly instalments.

So, the EMI calculation would be:

EMI = 200000* 0.0129 * (1+ 0.0129)^24 = Rs 9,745 / [(1+ 0.0129)^24 ]-1

The rate of interest (R) on your loan is calculated monthly i.e. (R= Annual rate of interest/12/100). For instance, if R = 15.5% per annum, then R= 15.5/12/100 = 0.0129.

The interest rates and your loan tenure are the vital deciding factors for your loan EMI. The higher the interest rate on the loan, higher will be your EMI and vice-versa. Similarly, a shorter loan tenure increases your EMI and vice- versa.