Proper closure of loans reflects good financial health

Credit bureaus are notified regarding loan closures by lending institutions, ensuring that there are no outstanding obligations in the borrower's name

There is a great sense of achievement, success, and satisfaction when you are about to pay that last equated monthly instalment on that home loan or personal loan for which you have been paying for the last 20 years. Ideally regular closure, pre-closure and part-payment are the three options for closing any personal loan. The traditional method or regular method of repaying a loan is to set monthly EMI and pay it on time each month. A borrower can also choose to end loan before completing the repayment period in a pre-closure or foreclosure. This is frequently done when a substantial chunk of money is received all at once that is close to the outstanding loan amount. The third option is to make a partial payment.

Depending on the bank, this entails the borrower paying a sum greater than a predetermined number (usually more than 2) of EMIs. One can avail of this option if they have extra money but not enough to completely repay the loan amount. Usually, this method leads to lowering of the outstanding principal and thereby the accrued interest.

Home loan

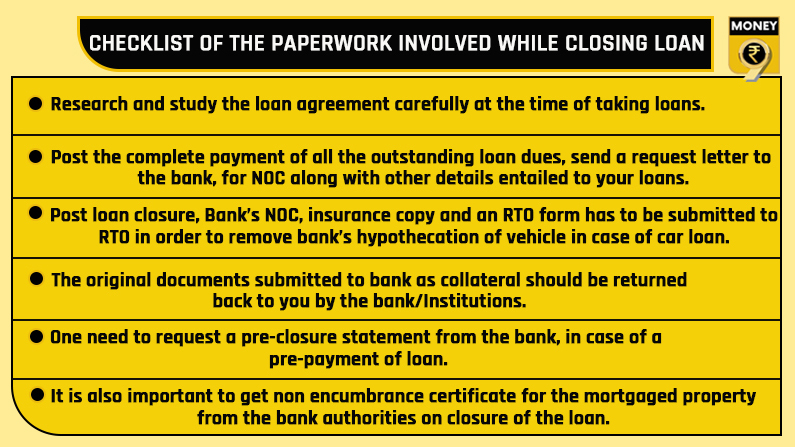

In the case of home loans that are on the floating interest rate, one piece of good news is that you can prepay your loan without incurring any additional prepayment penalties. However, because the house is mortgaged to the lending institution/bank, a checklist is required.

The bank should issue a NOC (No Objection Certificate) for the loan, detailing the borrower’s home address, name, and loan account number. It should also state that the borrower has paid all dues and that the lender has no rights or claims in the property.

The next step is to gather all original home paperwork that was delivered to the bank/HFC when the loan was taken out. The bank/HFC must release the lien on the property and update the CIBIL score of the borrower. Finally, a check on the destruction of post-dated checks presented to the bank/HFC when the loan was taken out.

Car loan

Traditional institutions’ that give vehicle or two-wheeler loans frequently come with prepayment penalties. The total outstanding principle amount and penalty charges and GST must be repaid at the time of prepayment. After that, a letter of authorisation i.e No Objection Certificate (NOC) from the financing institution is required. One would also like to remove the bank’s hypothecation of vehicle. After the loan has been paid off, Bank’s NOC, insurance copy, and a Regional Transport Office (RTO) form have to be submitted to RTO.

If a vehicle/two-wheeler the loan is not properly closed, although the borrower retains ownership of the vehicle, the lending institution retains the right to reclaim it in the event of repayment default. Many fintech companies are offering car and bike loan which has no prepayment charges.

Personal loan

A NOC document is provided to the consumer by the lending institution/bank once the loan has been fully repaid. This certificate confirms that there are no outstanding payments and that the loan has been fully repaid.

End Note

In the end the proper closing of loans, whether a home loan, a car loan or a personal loan, is critical because it reflects on the borrower’s financial health/score. Credit bureaus are notified regarding loan closures by lending institutions, ensuring that there are no outstanding obligations in the borrower’s name.