Cancer insurance: Everything you need to know

Cancer is as much a physical disease as a mental, societal and financial one. It has severe psychological impact on the patient ad well as the family

In the last few years, many cases related to cancer have been reported in India. In view of the increasing number of cancer patients and the corresponding cost of treatment, insurance companies now offer to provide financial assistance to those diagnosed with the disease after a free look period as per the policy’s terms and conditions.

So what does a cancer-specific insurance policy include? It covers costs for cancer diagnosis and treatment, including hospitalisation, chemotherapy, radiation and surgery among others.

“The money is usually payable at various stages of diagnosis including minor, major and critical stages. However, cancer insurance policies generally do not offer death, maturity or surrender benefits. In fact, it is also not limited to the actual expense in hospitalization for treatment,” PolicyBazaar.com quoted on its website.

In case you’re looking to buy cancer insurance, two conditions need to be fulfilled before moving towards potential plans and offers –

- You cannot be a cancer survior

- You cannot be suffering from any pre-existing cancer conditions

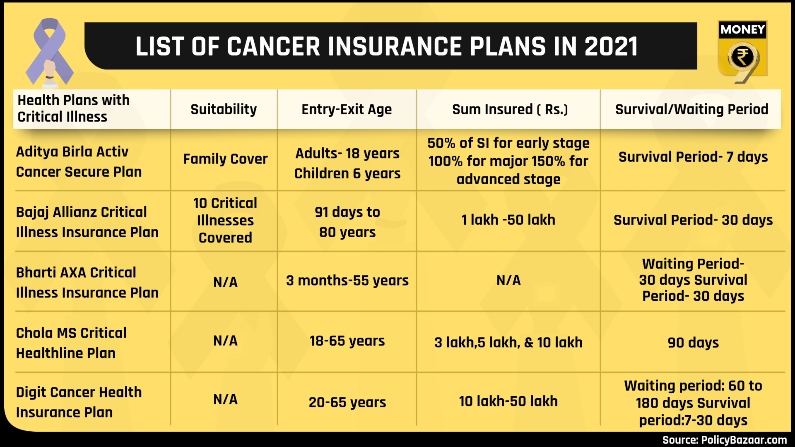

There are various insurance companies offering protection against the raging disease. These include Aditya Birla Activ Cancer Secure Plan, Bajaj Allianz Critical Illness Insurance Plan, Bharti AXA Critical Illness Insurance Plan, Chola MS Critical Healthline Plan, etc.

Inclusions & exclusions

Most insurance covers provide coverage against lung, breast, ovarian, stomach, hypolarynx and prostate cancer. In fact, if you are in the habit of getting frequent health checkups done from time to time, a grave disease like cancer can be detected at a nascent stage. This can be treated easily. Hence, whenever you take a cancer policy, keep in mind that to buy a cover that supports health checkups too.

Meanwhile, standalone cancer policies don’t cover skin cancer, any kind of cancer directly/indirectly contributed by sexually transmitted diseases, HIV, or AIDS. Pre-existing conditions or that induced by biological, nuclear, or chemical contamination, contact with radiation or radioactivity from any non-diagnostic or therapeutic source will also not be eligible for insurance.

Benefits of cancer insurance plans

One of the most important benefits available under this scheme is a premium waiver that can be availed in early-stage diagnosis. Insurance cover isn’t ceased after the first diagnosis and it also provides tax benefits under section 80D of the Income Tax Act.

Premium

Assuming you’re 35 years old, for a cover of Rs 10 lakh, average premium amount will come at Rs 250 monthly (for 20 years). For a cover of Rs 20 lakh, average premium amount will come at Rs 1,200 monthly (for 20 years).

Cancer insurance vs Critical illness plan

While a critical illness (CI) plan offers financial aid against a range of specific critical diseases like stroke, major organ transplant, paralysis, cardiac arrest, multiple sclerosis, kidney failure, total blindness, deafness, etc. Most of the plans cover cancer but only if it’s at an advanced stage. Moreover, critical illness plans are benefit plans that pay a lump sum amount on the diagnosis of the listed disease.

A CI plan is cheaper than comprehensive healthcare plans but it does not factor in several aspects of cancer treatment that a standalone cancer-specific policy provides. This includes coverage for post-treatment complications, treatment cost for early-stage cancer, etc. Also, in case the policyholder shows cancer symptoms within the first 90 days of buying the policy, the benefits will cease the exist.

Do you need a cancer insurance?

Cancer is as much a physical disease as mental, societal and financial one. It has a severe psychological impact on the patient as well as the family. Hence, it’s better to prevent one of the major causes of worry – that is the finances – to cover the cost of treatment. This is a plan worth considering if you have a family history of cancer. Even otherwise, if you’re the sole bread earner in the family or don’t have enough savings to pay for a disease as unpredictable and inevitable as cancer, have a protection plan.