Consumables cost in insurance going up; check out plans

Care Health, Max Bupa, Star Health and Digit Insurance have insurance products where consumables are covered

The hospitalisation due to Covid-19 was a nightmare during the second wave of the Covid-19. It put the insurers in the negative light that they were not settling claims, and even if they were, the deductions were steep. One reason for the deduction, however, was consumables such as gloves, sanitisers and PPE kits, which are not covered in any insurance policy.

“Initially, consumables formed just 2-3% of the total medical bill. The cost of it as a category has now increased to up to 15-20% because of more focus on hygiene as doctors and support staff have to wear PPE kits, gloves and following the Covid-19 sanitasation protocol such as sanitising CT scan machine everytime it has to be used,” says Amit Chhabra, Head – Health Insurance, Policybazaar.com.

With need, comes the solution

Since consumables resulted in flat deduction of a good claims amount, now there are policies covering these items. At least four insurers — Care Health, Max Bupa, Star Health and Digit Insurance — have insurance products where consumables are covered.

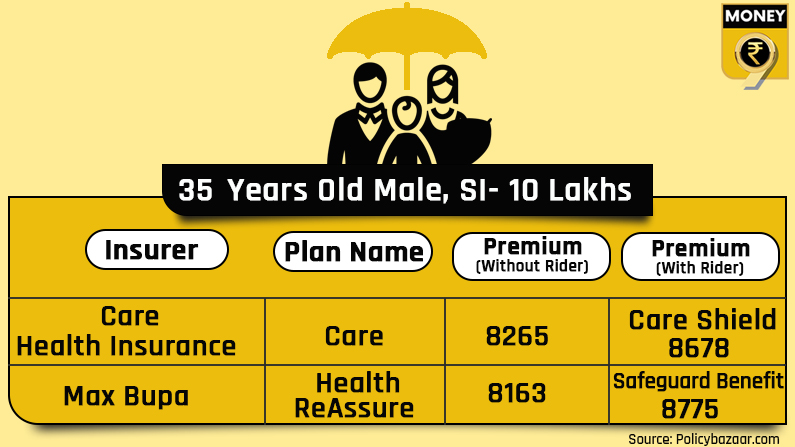

For example, Care Health Insurance and Max Bupa have products called Care Shield and Health ReAssure. You can add consumables coverage as a rider in these plans. Will it cost extra? Yes, but only marginally. The consumable rider may only cost you 5-7% of the policy premium. Policybazaar.com compiles the following table for comparison:

Policybazaar research noted the claims payout percentage of policies where consumables are covered is significantly higher than those without it.

“The claims payout is 10% higher in policies where consumables are covered. This is 95% in policies where it is covered and just about 80% in the ones where consumables are not covered,” said Chhabra.

What should you do?

The Covid-19 is not gone yet. The sanitisation protocol being followed in hospitals will continue for the time unknown. It means the proportion of consumables in medical bills will remain on the higher side. If you are a new policy buyer wishing to get consumables coverage, you should choose a policy where this feature is available. If you are an existing policyholder, you need to port to your favoured policy to get this coverage.

“Hospitalisation due to Covid-19 or otherwise, the level of precautions is almost the same. The doctors might be shuffling between Covid-19 and non-Covid-19 wards. It is must for them to follow full precautions. That said, consumable coverage is important. The industry is warming up to it and more insurers may have this rider in near future,” he said.