Insurance vs Assurance: What is the difference?

While renewability is a major concern for insurance policies, there is no such requirement under assurance plans

- Noopur Praveen

- Last Updated : August 13, 2021, 11:44 IST

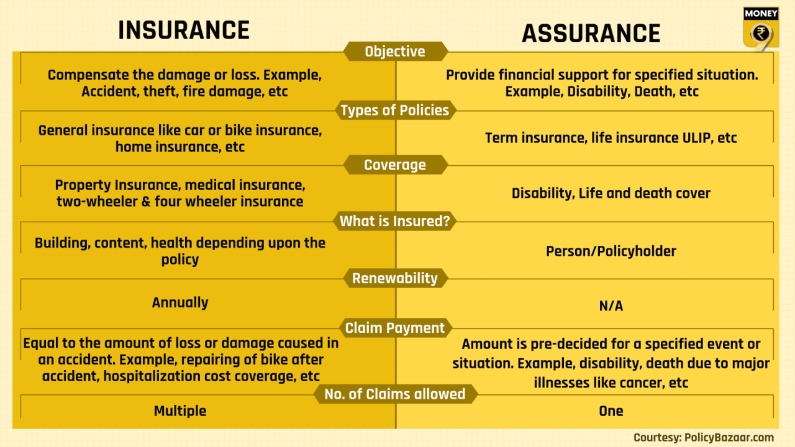

Have you ever confused the term ‘insurance’ with ‘assurance’? While both these words are often used to describe a situation when the insurer provides financial aid against a legitimate claim filed by the policyholder, there are major differences between them. Insurance refers to the coverage provided for a limited time. On the other hand, assurance means consistent coverage applied for extended periods or until death. Let’s take an example to understand the difference between insurance and assurance.

Imagine that you purchased a car and purchase a comprehensive insurance policy that can provide overall coverage to the third party as well as you. Now, such plans provide protection against loss or damage caused to your car. It could be theft, injury, personal accident cover and loss of life. This means you have a financial backup for all the above-stated circumstances. Insurance renewal is critical and must be taken care of. This is a classic example of insurance.

Meanwhile, the term ‘assurance’ is used to cover life and term insurance policies. In a life insurance policy, the insured is given assurance of compensation in case of eventualities like death or physical disability. In case, the policyholder outgrows the maturity period, they have an option to receive the claim amount on monthly basis as a pension. Policies under assurance have a longer duration than general insurance policies.

If you purchase an endowment plan with a sum insured amount of Rs 25 lakh, it will provide dual benefits. If you survive till the maturity of the policy, a lump sum amount will be provided from your insurer. However, in case of your death during this period, then the nominee will receive the sum insured amount. Term insurance, ULIP, and whole life policies are other examples of life insurance covered under assurance.

While renewability is a major concern for insurance policies, there is no such requirement under assurance plans. Besides, insurance offers multiple claims and assurance provides one-time claim.

Buying a general insurance policy gives you assurance that the insurance company will provide financial support in case of any loss or damage caused to the insured. Meanwhile, you get a good return on the maturity of the policy under a life insurance policy. It’s important to, however, know the technical difference between interchangeable terms used within the insurance industry.

Despite being aware of these key differences, it’s always advised to read and re-read the policy document, fine print and sub-limit clause to avoid any issues later.

Download Money9 App for the latest updates on Personal Finance.

Related

- अब महज 15 दिनों में होगा डेथ क्लेम सेटलमेंट, IRDAI ने बीमा कंपनियों को दिए सख्त निर्देश

- Health insurance vs. Medical corpus: What’s your choice?

- Can Homebuyers Expect Tax Rebate from Budget’24?

- Budget 2024: Insurers anticipate tax reforms in health insurance

- Claim rejected even after completing Moratorium Period?

- Be Monsoon Ready with Home Insurance Damage Cover