LIC Nivesh Plus: Here’s all you need to know

On payment of single premium, the plan offers insurance cum investment cover throughout the term of the policy.

- Rahul Chakraborty

- Last Updated : October 28, 2021, 17:19 IST

Nivesh Plus, which was launched in 2020, is already one of the most popular policies of Life Insurance Corporation of India (LIC), the country’s largest insurer. It is a unit linked, non-participating, single premium individual life Insurance plan. On payment of a single premium, the plan offers insurance cum investment cover throughout the term of the policy. One can buy this policy offline as well as online modes through the official website of LIC and its mobile app.

Eligibility

Minimum entry age: 90 days

Maximum entry age: 70 years

Minimum maturity age: 18 years

Maximum maturity age: 85 years

Policy term: 10 years to 25 years

Premium paying mode: Single premium only

Minimum premium: Rs 1 lakh

Maximum premium: There is no limit, but premiums shall be payable in multiples of Rs 10,000

Basic sum assured

Under this plan you have the flexibility to choose the type of sum insured at the inception. Once selected, the option cannot be altered. The options are:

Option 1: 1.25 times of single premium

Option 2: 10 times of single premium

Death benefit

On the death of the insured, the nominee will receive the death benefits. In case of death before the date of commencement of risk, an amount which will be equal to the unit fund value will be paid. If the death occurs after the date of commencement of risk, an amount which will be higher of basic sum assured or unit fund value is payable.

Maturity benefit

On life assured surviving the date of maturity, an amount equal to unit fund value shall be payable.

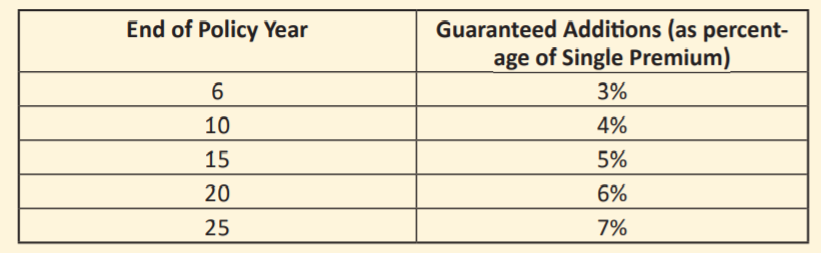

Guaranteed additions

LIC Nivesh Plus Plan offers guaranteed additions. It will be a fixed percentage of the single premium as mentioned below.

Partial withdrawals

The plan allows for partial withdrawals after completing five years of the policy. It can be in the form of a fixed amount or fixed number of units. The maximum amount of partial withdrawal is up to 30% of the fund. In the case of a minor, the partial withdrawal is allowed after 18 years of age. Partial withdrawal charge shall not exceed Rs 500 on each withdrawal.

Switches

The plan allows the insured to switch among four different funds during the fixed policy tenure. You have an option to switch between the four fund types during the policy term. If the insured opts for switching, the entire fund value will get the switch to the new fund. Switching shall be subject to switching charges. Charge shall not exceed Rs 500 per switch.

Surrender

The insured is allowed to surrender the policy in case of need.

Loan

The policyholder can not avail loan against LIC Nivesh Plus policy.

Download Money9 App for the latest updates on Personal Finance.

Related

- अब महज 15 दिनों में होगा डेथ क्लेम सेटलमेंट, IRDAI ने बीमा कंपनियों को दिए सख्त निर्देश

- Health insurance vs. Medical corpus: What’s your choice?

- Can Homebuyers Expect Tax Rebate from Budget’24?

- Budget 2024: Insurers anticipate tax reforms in health insurance

- Claim rejected even after completing Moratorium Period?

- Be Monsoon Ready with Home Insurance Damage Cover