No additional burden on third party cover

The department of road transport and highways has decided to not hike third party premiums this year. Third-party insurance is legally mandatory for every car, bike or other motor vehicle to drive on Indian roads.

In what can be seen as a massive relief to motor vehicle owners, the department of road transport and highways has decided to not hike third party premiums this year. Third-party insurance is legally mandatory for every car, bike or other motor vehicle to drive on Indian roads.

What is third-party insurance?

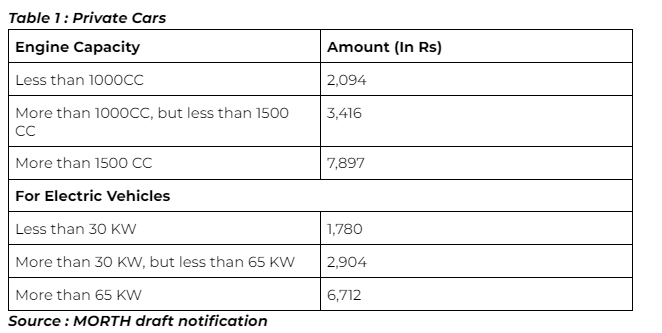

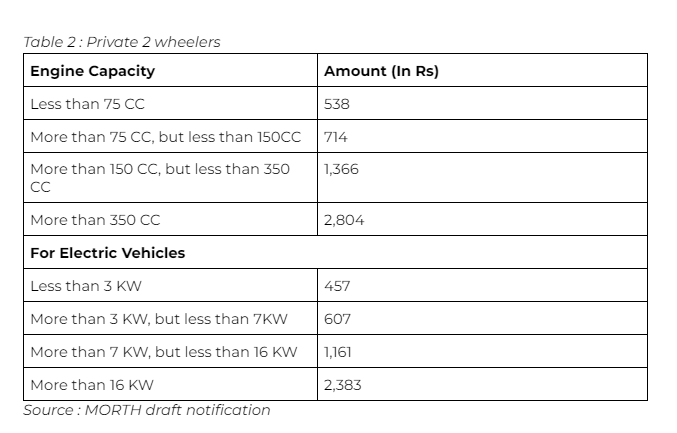

It provides cover for material damage and physical injury of a third party, which might be directly caused by your vehicle. However, no assistance is given to the policy i.e. car owners in case of such an incident. Here is a comprehensive list of premiums proposed, as per the draft notification, for various categories of vehicles.

Additionally, discounts have been proposed for different segments of vehicles, slashing their base premium when it comes to third party insurance for unlimited liabilities. Here is a list of such discounts on premiums made available

Last year, insurance regulator IRDAI had introduced a long-term third-party policy. Under this, you could take third-party insurance coverage for a new car for a period of 3 years at one go. For new, private two wheelers, this duration was determined at 5 years. Herein, the policyholder is required to pay the entire premium amount in one go, while purchasing the policy. Here is a list of long-term premiums mandated by the government.