OPD insurance cover: Should you opt for it?

Considering not all medical treatment need hospitalisation, OPD health insurance plans cover doctor’s consultation fees, cost of medicines, etc

Whenever Radhika Kumari, 35, falls sick, she prefers going to her childhood doctor, who visits a private hospital in the neighbourhood. Recently, when she fell ill, she found out that the doctor has stopped visiting that hospital. So she had no choice but to travel a long distance to get examined by him in a big multi-speciality hospital. “I realized that due to the bigger brand of the hospital, his consultation fees had doubled from Rs 500 to Rs 1,000. So I paid the fees as I wanted to be treated by him only.”

Many like Radhika feel the burden of the high cost of out-patient departments (OPDs), especially those who require a regular doctor’s consultation, including senior citizens who constantly need medical care. They spend a lot on OPDs, on diagnostics, on pharmacy, and so on.

OPD has become a big piece of health expenditure, hurting people’s pockets as the charges are pretty expensive and are mostly met out of pocket. Consider this: according to the World Health Organisation data out-of-pocket expenses are very high in India at 62% of total healthcare expenses. In developed countries such as the United States and the United Kingdom, the figure is around 10-16 %. In South Africa, it is just 7.72% and around 35% in China. Considering such expenses constitute a large portion of health expenses, do we have adequate covers to finance OPDs?

What are OPD plans?

OPD plans cover the outpatient department expenses such as doctor consultation fees, medicines, among other things. The regular doctor’s visit is not covered under the basic health insurance plan, as it covers medical expenses only after the hospitalization of at least 24 hours. OPD plans help the insured to claim costs other than those incurred during hospitalisation.

How to buy OPD cover?

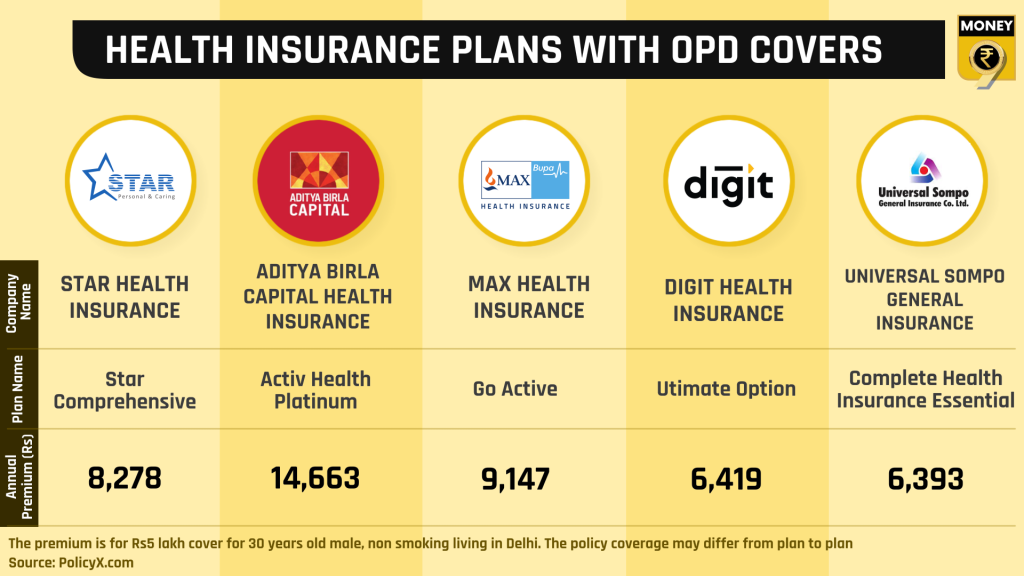

There are two options to buy an OPD cover- either as inbuilt in the base plan or as a rider. “OPD charges are quite expensive. Hence, some insurance companies have started giving OPD coverage under the base plan itself. However, they might come with some sum insured capping or other conditions such as only reimbursement option. If a person doesn’t have an OPD inclusive base plan, it can also be clubbed as a rider by paying a minimal extra premium,” said Naval Goel, founder and CEO, PolicyX.com.

How to claim?

The claim process can be a bit hectic as OPD claims can only be done via reimbursement. The policyholder needs to fill the form with proper bills and other required documents to claim the amount. Unfortunately, there are rarely cashless services available.

Should you opt for OPD covers?

OPD covers are pretty expensive compared to the sum insured offered. For instance, if the policy permits Rs5000 OPD sum insured for a year, then the additional charges in premium would be close to Rs 3,500. However, the high cost makes it suitable for those who either have some medical conditions such as low immunity or any other thing which requires a regular doctor’s consultation.

Having said that your basic health policy already offer OPD benefits but only in the case of hospitalisation. “When you look closely, most health insurers offer coverage for inpatient, day-care hospitalisations and inpatient hospitalisation claims. In maximum cases, the policyholder gets OPD benefits such as medicines, consultations and diagnostic tests under pre-hospitalisation i.e. 30-90 days and post-hospitalisation i.e. 60-180 days that suffices the need for OPD.”