SBI Life’s eShield Next personalises your term insurance plan

eShield Next the new term insurance policy from SBI Life offers customisation to the insured to increase the sum assured based on their life stage.

- Teena Jain Kaushal

- Last Updated : August 20, 2021, 13:20 IST

SBI Life has launched a term insurance policy called ‘eShield Next’ that offers a choice to customise the plan according to changing needs. The term plan gives the insured an option to increase the sum assured on attaining important milestones in life, like getting married, becoming a parent or buying a new house. Similarly, the policy gives an option to increase the sum assured in tune with rising inflation. Not only in terms of sum assured, but the policy also offers customisation while offering death benefits. Here are the details:

Three Plan Options

Level cover benefit

This is like a regular term plan where the sum assured remains fixed throughout the policy term.

Increasing cover benefit

As inflation goes up with time, insurance cover under this option also grows automatically. Here sum assured increases by 10% p.a. of the basic sum assured at the end of every 5th policy year, subject to a maximum increase of up to 100% of basic sum assured. Assume a person aged 35 years buys the policy with a basic cover of Rs 1 crore for a term of 30 years. If the death occurs in the 14th policy year, the sum assured payable on death would be Rs1.2 crore (Rs 1 crore + 2 increases of Rs 10 lakh each). However, this increase will not be applicable after attaining the age of 71 years. The premium is decided at the inception of the policy and it remains constant throughout the policy term.

Level cover with future proofing benefit

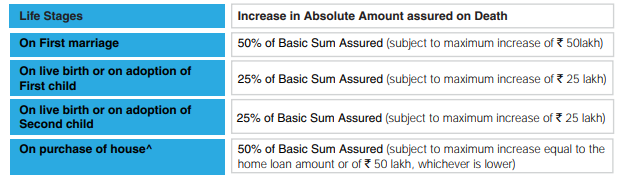

With changes in your life, it might not always be possible to buy a new additional insurance coverage each time. For example when you get married or have kids your liabilities increase for which you need to increase your sum insured as well. Thus, to ensure that your protection needs match with the changes in your responsibilities at important life stages, this option has been designed.

One of the biggest advantages is that without further medical underwriting one get an enhanced sum assured. For example, consider a 30-year-old buy this option for a policy term of 20 years with a basic sum assured of Rs 1 crore. Now if the person gets married after 2 years, he can opt for a higher sum assured in tune with rising responsibilities. After making a request for an increase in sum assured and acceptance of the request, the sum assured will be increased by 50% to Rs 1.5 crore. Similarly after having a kid sum assured can be requested to be increased Rs1.75 crore.

Death Benefit

Not only in terms of sum assured, but the policy also offers customisation while offering death benefits. One can either choose to get a lump sum amount or in instalments payable every year for a period of 5 months. There is also an option to get both lump sum and a monthly option where 50% of the death benefit will be payable as lumpsum and 50% of the death benefit will be payable as monthly instalments for the period of 5 years.

Better half benefit

Under this option, if the life assured dies within the policy term then the spouse gets automatically insured for the rest of the policy term. The sum assured would be a level cover, irrespective of the plan option chosen by the life assured. Moreover, the cover on the life of the spouse starts from the date of death of the life assured.

The option gives an additional advantage like on the death of the spouse or on the diagnosis of terminal illness, before the maturity date, the policy pays a lumpsum benefit of Rs 25 lakh irrespective of the death benefit payment mode opted by the life assured under the plan. No future premiums are payable under the policy, after the death of the life assured.

Premium rate

For a 30-year-old non-smoker male, the level cover of Rs 1 crore is available at Rs 11,595. For increasing cover benefit the premium rate will be Rs 13964 and for level cover with future proofing benefit the premium rate is Rs 11595. You can choose and customise your cover depending on your requirements.

Download Money9 App for the latest updates on Personal Finance.

Related

- अब महज 15 दिनों में होगा डेथ क्लेम सेटलमेंट, IRDAI ने बीमा कंपनियों को दिए सख्त निर्देश

- Health insurance vs. Medical corpus: What’s your choice?

- Can Homebuyers Expect Tax Rebate from Budget’24?

- Budget 2024: Insurers anticipate tax reforms in health insurance

- Claim rejected even after completing Moratorium Period?

- Be Monsoon Ready with Home Insurance Damage Cover