Standard term life insurance policies: Should you go for one?

First-time insurance buyers and individuals going for small loans may find this product suitable for their needs

- Sarbajeet K Sen

- Last Updated : February 20, 2021, 10:57 IST

Buying term life insurance should ideally be one of the first steps in the financial planning of an individual. The Insurance Regulatory Development Authority of India has now made it simple by mandating insurance companies to launch standard term life insurance policy offerings.

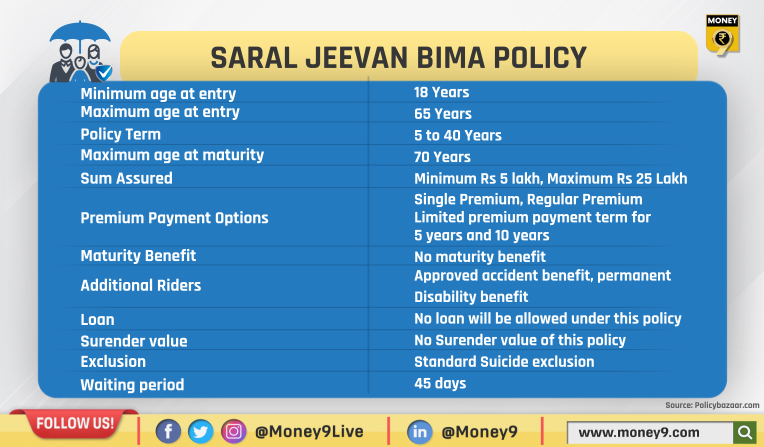

According to the IRDA’s October 2020 directive, the product would be named as Saral Jeevan Bima Policy (SJBP) with the name of the insurance company prefixed with the product name. Each life insurance company has to offer this product. The regulator has clearly defined the policy.

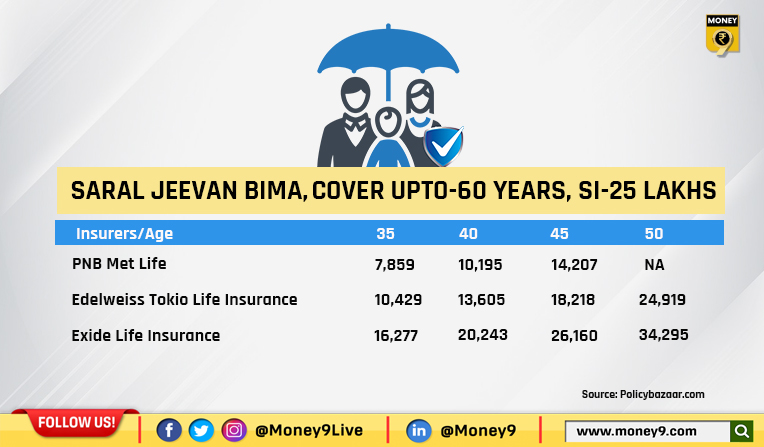

However, the regulator has left the pricing (premium payable) to the life insurance company. Insurance companies will charge the premium based on gender, age and sum assured among other factors. The product suits all those looking for a pure risk term life insurance.

Why SJBP?

There are many term life insurance policies available in the market. Each life insurance company offers a wide variety of benefits – premium paying term, death claim settlement options, term of the policy and option to receive the premium at the time of maturity. That makes an apple to apple comparison almost impossible. SJBP is a pure risk term life insurance product with standard conditions and hence investors may find it easier to compare and choose the cover that suits their needs.

“For the first time buyers of term life insurance, the product is a boon since the plan is the same across all insurers. The plan is a one-stop-solution for first time term life insurance buyers. Also, people with limited understanding of term life insurance are often not able to choose which plan to invest in for the financial security of their dependents. The introduction of Saral Jeevan Bima is being seen as a revolutionary move in the life insurance industry as it will bring maximum people under the insurance umbrella,” said Santosh Agarwal, CBO, Life Insurance, Policybazaar.com.

Self-employed can take advantage

The SJBP will make it easier for many self employed people falling in the lower income category to have a term insurance to protect their family. “Earlier, the self-employed people with an annual income of Rs 3-5 lakh were not able to get the term insurance due to unavailability of income proof. Now with the launch of SJB plans the chance of issuing a term insurance policy to this segment has improved. SJBP provides the option of income surrogate where you can submit the RC of your car or two-wheeler as a surrogate to your income proof.

“While the progress is going in the right direction,” Agarwal pointed out. She expected the issuance rate to this segment to go up to 70% which was earlier only 30%.

Also, first-time insurance buyers and individuals going for small loans may find this product suitable for their needs. If you are living in a second-rung city and going for a home loan, this can be an ideal product to cover your liability in case of eventuality.

Beware of limitations

The product has no investment component. That should ensure that the life insurance companies charge less in line with most term life insurance plans. Since this is a standardised product across life insurance companies, companies may offer aggressive (low) rates to attract insurance buyers.

For those looking for large sum assured, other term life insurance products appear to be the only option.

SJBP comes with accident benefit and permanent disability benefit. However, the policy does not offer critical illness cover as an optional rider benefit.

“One can always go for critical illness policy along with a term or health insurance plan. Life is unpredictable and Illnesses always come unannounced and can affect your physical as well as financial well-being. A critical illness insurance cover provides a lump sum benefit to cover the cost of treatment arising from specific illnesses and the associated recovery expenses,” Agarwal said.

SJBP has a waiting period of 45 days from the date of issue of the policy. In this period, only death claims arising out of accident will be paid.

Insurance buyers need to keep in mind these limitations and then take an informed call, before buying this policy.

Download Money9 App for the latest updates on Personal Finance.

Related

- साउथ इंडियन बैंक का दूसरी तिमाही का शुद्ध लाभ आठ प्रतिशत बढ़कर 351 करोड़ रुपये हुआ

- एसबीआई जनरल इंश्योरेंस, स्टारफिन इंडिया ने कम आय वाले परिवारों के लिए पेश की योजना

- अब महज 15 दिनों में होगा डेथ क्लेम सेटलमेंट, IRDAI ने बीमा कंपनियों को दिए सख्त निर्देश

- Health insurance vs. Medical corpus: What’s your choice?

- Can Homebuyers Expect Tax Rebate from Budget’24?

- Budget 2024: Insurers anticipate tax reforms in health insurance