Why Term Plans with return on premiums are not what your financial health needs

It is well known that term plans have the cheapest premium payable. In contrast, premiums payable under a TROP are twice or thrice of this figure.

- Ira Puranik

- Last Updated : August 1, 2023, 17:51 IST

45-year old Abhinav had always been an insurance-skeptic. But his reservations were particularly intense for pure term insurance. According to him, it was worthless, since he would not be alive to reap the benefits of the many, many years of premium he would pay for the policy.

So, when he heard that there are term policies that pay back the entire premium amount, provided the insured person survives the policy tenure, his interest was piqued. He thought them to be far better than those regular, vanilla term insurance plans.

If you are thinking along the same lines, stop. As lucrative as they may look, you are better off with a pure term insurance. Read on to know why.

Stay away from fancy-looking TROPs

Just last week, LIC launched Jeevan Kiran, a TROP (term return on premium) life. Under this, if the insured individual outlives the policy period, the total premium amount received from him/her during the policy period, if he outlives this time. Most of the time, such policies promise you life protection, along with payback. But that’s not the case.

What happens if Abhinav opts for a policy like this?

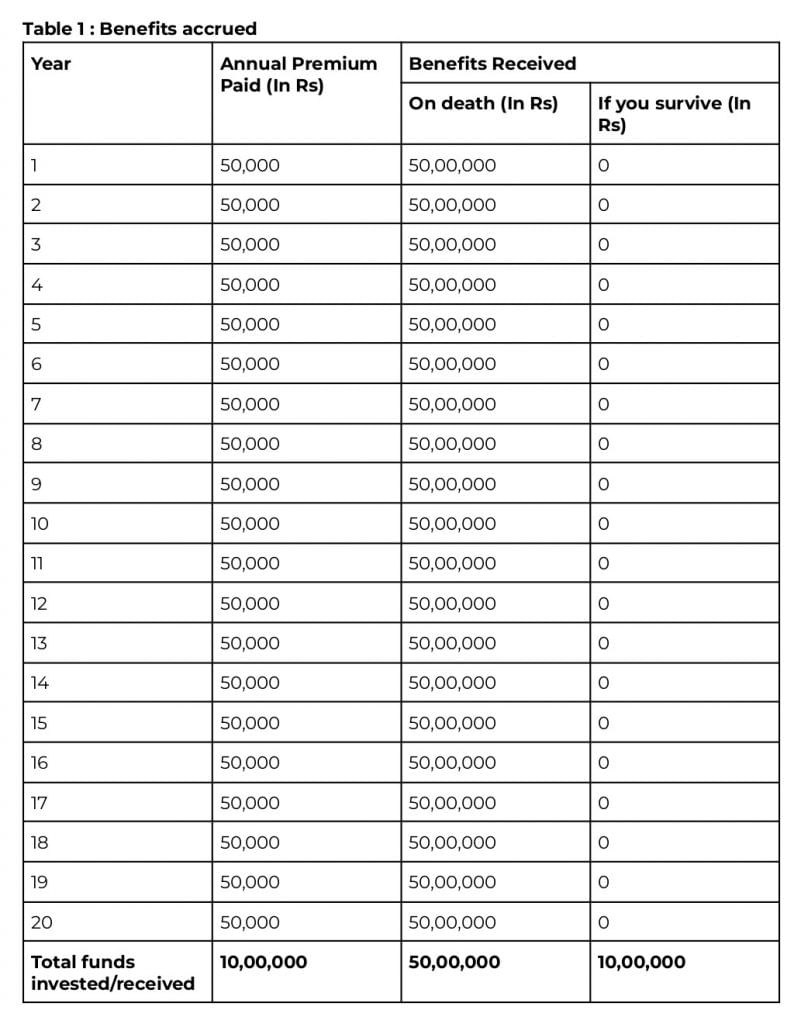

Here are the details of Abhinav’s hypothetical TROP:

- Basic sum assured (i.e. amount received if policyholder dies within policy tenure): Rs 50,00,000

- Annual Premium Payment (under regular plan) : Rs 50,000

- Policy tenure opted for : 20 years

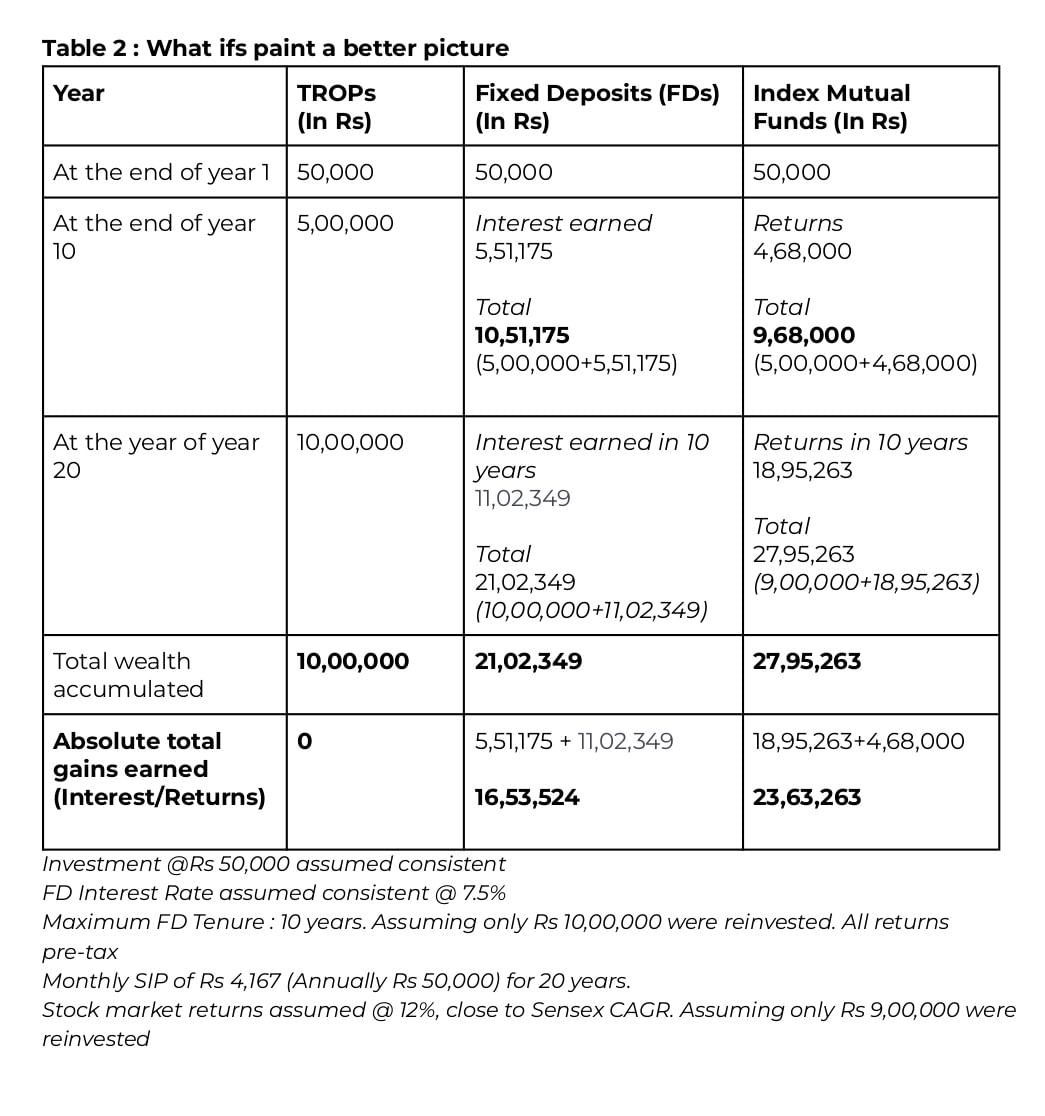

Now, instead of waiting out the policy period for accumulating Rs 10,00,000 for 20 years, had he invested this amount in either FDs or stock markets, here’s how it would have panned out for him.

Now, instead of waiting out the policy period for accumulating Rs 10,00,000 for 20 years, had he invested this amount in either FDs or stock markets, here’s how it would have panned out for him.

Clearly, these policies don’t make for good investments. And if you’re looking simply for the benefits offered by term insurance i.e. death benefits, a pure term plan is far more effective.

Clearly, these policies don’t make for good investments. And if you’re looking simply for the benefits offered by term insurance i.e. death benefits, a pure term plan is far more effective.

Why simple is best? The sum assured under any standard term life insurance policy would have remained similar, irrespective of it being a This means Abhinav would’ve gotten a cover for Rs 50,00,000 at far less premium. It is well known that term plans have the cheapest premium payable. In contrast, premiums payable under a TROP are twice or thrice of this figure. Moreover, rising inflation will further erode the value of these Rs 10,00,000, meaning you’ll be left with less in hand than what meets the eye. For instance, what costs Rs 10,00,000 today will cost Rs 22,07,135 in the next 20 years, assuming inflation stays at 6%. In such a case, the final payout won’t be worth much.

Says financial planner Nema Chaya Buch, “While financial requirements may differ for every individual, knowing what is the objective of buying a term insurance plan with the return of premiums is very important. You may avail tax benefits on premiums paid, but since survival benefits will be taxable, you will be badly hit by both inflation and tax, at the end of the day.“If you’re seeing such policies from an investment angle, that is not feasible. Keep investment and insurance separate. Consider life insurance plans if you also want to avail survival or the maturity benefit. If you are not considering survival/maturity benefits then go for a pure term insurance plan, it would be cheaper”, she signs off.

Download Money9 App for the latest updates on Personal Finance.

Related

- अब महज 15 दिनों में होगा डेथ क्लेम सेटलमेंट, IRDAI ने बीमा कंपनियों को दिए सख्त निर्देश

- Health insurance vs. Medical corpus: What’s your choice?

- Can Homebuyers Expect Tax Rebate from Budget’24?

- Budget 2024: Insurers anticipate tax reforms in health insurance

- Claim rejected even after completing Moratorium Period?

- Be Monsoon Ready with Home Insurance Damage Cover