Cryptocurrency news: Dogecoin gains 4.3%, Bitcoin climbs 3.5%

Top cryptocurrency prices today: Among other virtual currencies in the top-10 list, XRP dropped 0.16% to $1.26

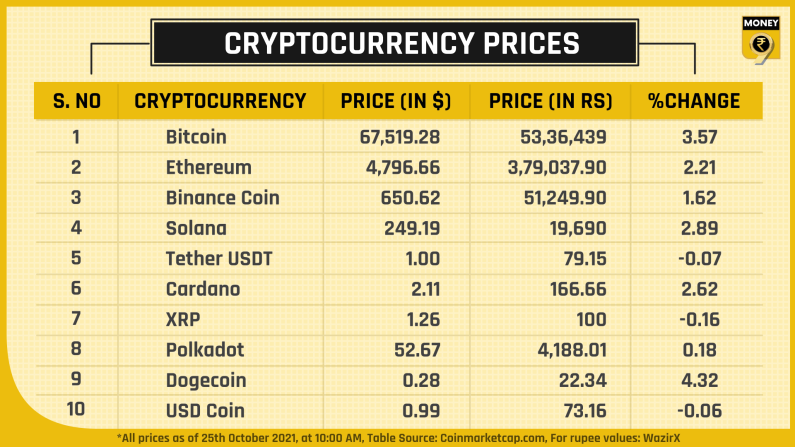

Seven of the top ten cryptocurrencies were trading in the green on Monday with Dogecoin adding 4.32% to $0.28, while the world’s oldest and largest cryptocurrency Bitcoin advanced 3.57% to $67,519.28.

The second-largest token Ethereum added 2.21% to $4,796.66. Solana climbed 2.89% to $249.19. Similarly, Cardano rose 2.62% to $2.11 and Binance Coin rose 1.62% to $650.62. Among other virtual currencies in the top-10 list, XRP dropped 0.16% to $1.26.

In terms of ranking, all the cryptocurrencies retained their previous slots.

Cryptocurrency prices

Mastercard set to launch crypto linked payment cards in Asia Pacific

Mastercard has entered into a partnership with cryptocurrency service providers Amber, Bitkub and CoinJar to launch its first crypto-funded payments cards in the Asia Pacific (APAC) region. The payment card company had said in February this year, that it will begin supporting cryptocurrencies in its network.

The announcement comes on the back of some merchants accepting payments in digital currencies like Bitcoin and Ethereum. 45% of those living in APAC are considering cryptocurrencies as a mode of payment next year, as per a Mastercard survey.

Thailand-based Amber Group and Bitkub, along with CoinJar based out of Australia offer cryptocurrency purchase and exchange services in their respective domestic markets. These are the first APAC-based cryptocurrency platforms to join Mastercard’s global crypto card programme that lets cardholders convert their crypto holdings into a fiat currency.

India may not take a tough stance on cryptocurrencies

As India finalises its legislation on crypto assets which is set to be introduced in the upcoming winter session in the parliament, an outright ban on cryptocurrencies is highly unlikely owing to the huge investments in such instruments by people. It might also not be considered legal tender as well.

According to a news report in The Economic Times, a middle path that balances the concerns of all stakeholders is more likely.

Recently, a detailed presentation was made before policymakers, including from the Ministry of Finance on the pros and cons, regulations adopted by other countries, investments made by Indians in digital currencies and the Reserve Bank of India’s (RBI) stance on the issue.

Another presentation is set to happen in the near future which would finalise the taxation aspects emerging from the trading of digital currencies and after the legal vetting, it would go to the cabinet, the publication said.

Download Money9 App for the latest updates on Personal Finance.

Related

- Budget’24: New LTCG rule to hit long-term property owners hard

- Looking to buy gold? Buy now before it’s too late!

- Budget 2024: What is NPS ‘Vatsalya’ scheme? How to apply & other benefits?

- Budget’ 24: Startup ecosystem all smiles with scrapping of angel tax

- Budget’24: New NPS scheme for minors launched, here’s how you can benefit

- Budget’24: Gold, silver prices to soften soon, customs duty drops to 6%