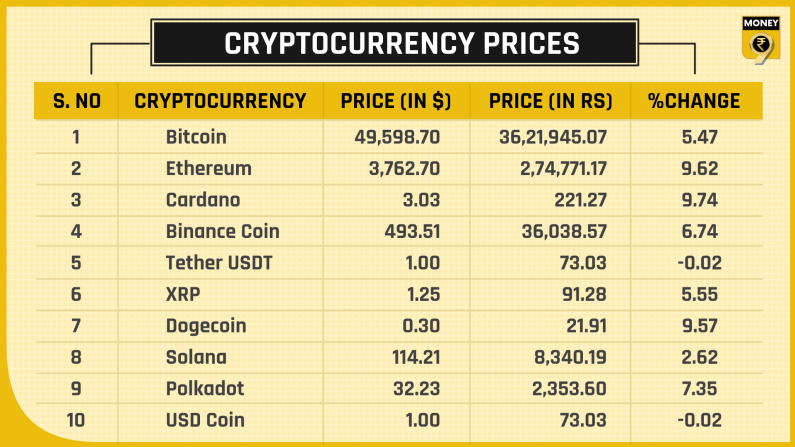

Cryptocurrency update: Cardano gains 9.7%; Dogecoin jumps 9.5%

Top cryptocurrency prices today: Bitcoin increased by 5.47% and was trading at $49,598.70 levels, while Ethereum also increased by 9.62% to $3,762.70

Eight out of the ten cryptocurrencies were trading in the green on September 2, with Alt coin Cardano gaining as high as of 9.74% in the last 24 hours. The second-largest virtual token, Ethereum also advanced 9.62% to $3,762.70. Dogecoin gained 9.57% to $0.30, while Bitcoin, the biggest and the oldest cryptocurrency, jumped 5.47% to $49,598.70 levels. Only Tether USDT and USD Coin were in red.

Cryptocurrency Prices

*All prices as of 2 September 2021, at 9:30 AM, Table Source: Coinmarketcap.com. Conversion rate for the USD to INR used was $1=Rs 73.03

Confusion continues on taxing cryptocurrency gains

Calculating gains on cryptocurrencies for purposes of taxation has put investors and tax departments in a dilemma, as tax laws conflict against certain regulations. Also, tax is calculated on the value declared by assesse.

The big question is it going to be the (First In First Out) FIFO method? or is it the (Last In First out) LIFO method?

For example, if an investor bought one bitcoin in 2017 for $1,000 and another in 2018 for $13,000,then in 2020 he sells one of his bitcoins for $7,000. Now for taxation purposes, it is important to know which bitcoin he sold, the one in 2017 or the one in 2018.

The Economic Times reported that if the FIFO method is applied, the tax will be on the gains of $6,000, and if the LIFO method is applied there would be no taxes applied.

Due to the nature of cryptocurrencies, ascertaining the cost and gain are tricky. Also, tax is levied on gains which are sales price minus cost, the publication said.

Investors and traders will be able to get around the taxation of cryptocurrencies until it is articulated as to what they are, whether they are an asset, currency, commodity or something else. Also, tax rates differ for someone who is an investor and someone who trades the same for a living.