Everything you need to know on taxation of NRIs

NRIs are taxed on the income they receive or are deemed to receive in India and accrue/arise or are deemed to accrue/arise in India

- Himali Patel

- Last Updated : July 6, 2021, 20:14 IST

For Non-Resident Indians (Indian citizens or persons of Indian origin who have been residing outside India), the Indian tax regulations were extremely favourable until 31 March 2020; in general, NRIs who visited India could stay up to 181 days in a fiscal year and retain their “Non-resident” status in India.

The Finance Act, 2020 and the Finance Act, 2021 (assented by the President on 28 March 2021) made significant changes and clarifications, resulting in considerable confusion regarding the determination of NRIs’ residential status for the fiscal year ended 31 March 2021 and the fiscal year ended 31 March 2022.

“Residential status is crucial to the NRIs as it is determined every financial year, and it also forms the base of levying income tax on every person. The residents are liable to pay tax on global income, whereas non-residents are liable to pay tax on income which is accrued or received in India,” pointed out Manish Hingar, Founder, Fintoo.

How person’s residential status is taxed?

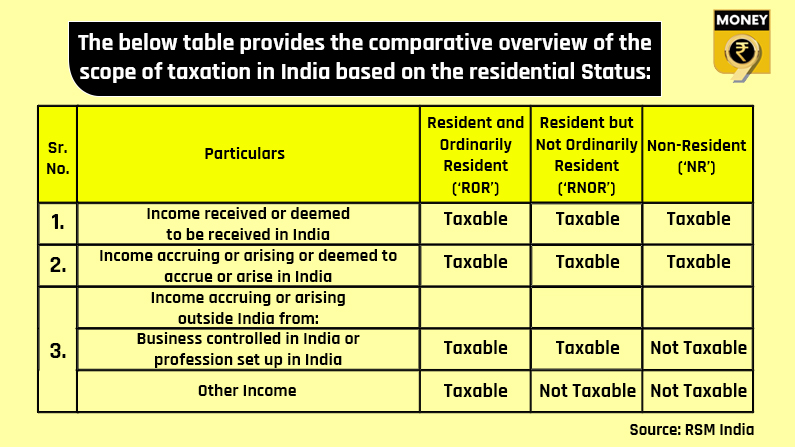

Income is taxable in India based on a person’s residential status during a given tax period.

-Individuals can be classified as Resident and Ordinarily Resident (RoR), Resident but Not Ordinarily Resident (RNoR), or Non-Resident for tax purposes (NR). The taxes of various sources of income are determined by the taxpayer’s residency status.

-Residents (i.e., those who are RoR) are taxed on their global income, whereas NRIs are taxed on the income they receive or are deemed to receive in India and accrue/arise or are deemed to accrue/arise in India.

(See the Table: The comparative overview of the scope of taxation in India based on the residential Status)

Why is residential status crucial to NRI’s?

To invest wisely, an NRI must be informed of all available investment opportunities. An NRI can invest in a variety of financial products, including money market mutual funds, fixed deposits, treasury bills, government securities, real estate, certificate of deposits, and company deposits.

Prior to investing, an investor should consider the tax ramifications and repatriation requirements, as there are various limits on bringing investments made in India back to the investor’s home country.

“The NRI investors should be aware that interest earned on Non-Resident External (NRE) and Foreign Currency Non-Resident Account (FCNR) deposit is exempt from income tax, subject to certain conditions. However, the interest income on the Non-Resident Ordinary (NRO) account is taxable,” said Suresh Surana, Founder, RSM India.

Today there are several benefits that are not made available to the NRI’s, for instance, Rebate u/s 87A, the benefit of higher basic exemption limit for senior and super senior citizens, etc. Hence, it is important to determine the residential status of any individual taxpayer in order to determine their scope of income which is taxable in India, and accordingly to compute their appropriate tax liabilities.

That said, there are situations where NRI’s may be potentially taxed twice in both the countries, i.e., in India (the source country) and the country of residence. Tax relief from a Double Tax Avoidance Agreement (DTAA) that exists between two countries can be sought.

“It is advisable for such Non-Residents to obtain the Tax Residency Certificate (TRC) of such countries where they are residents, to avoid double taxation or to obtain the tax credit of taxes deducted in India, as the case may be,” explained Surana.

Download Money9 App for the latest updates on Personal Finance.

Related

- Budget’24: New LTCG rule to hit long-term property owners hard

- Looking to buy gold? Buy now before it’s too late!

- Budget 2024: What is NPS ‘Vatsalya’ scheme? How to apply & other benefits?

- Budget’ 24: Startup ecosystem all smiles with scrapping of angel tax

- Budget’24: New NPS scheme for minors launched, here’s how you can benefit

- Budget’24: Gold, silver prices to soften soon, customs duty drops to 6%