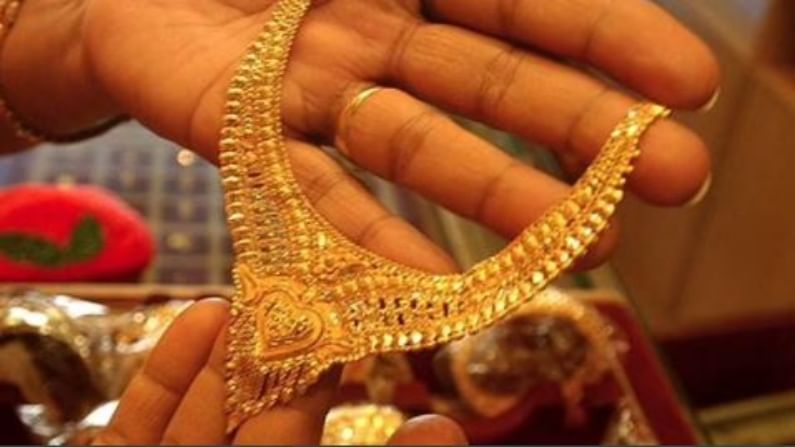

Gold price today 13 September 2021: Yellow metal trading flat; check rates in Delhi, Mumbai and Kolkata

Gold prices are vulnerable after a steep fall last week and trading below $1790/oz in the international market

After three back-to-back negative sessions, gold price on September 13 remained flat. The 24-carat variant of the yellow metal was trading at Rs 47,063/10 gm on September 13, up by only Rs 53 from the previous close of Rs 47,010/10 gm on September 9, according to the rate provided by the Indian Bullion and Jewellers Association (IBJA). The price of 22-carat gold was also up by Rs 49 and reached Rs 43,110/10 gm. The previous closing price was Rs 43,061/10 gm.

“Gold prices are vulnerable after the steep fall last week and was trading below $1,790/oz while higher treasury yield and strong dollar were key drivers for this price correction. The longer it stays below $1,800, the more it is at risk of another sell off with next key daily support at $1s700/oz. The volatility in the global equity markets is increasing which could be the new catalyst the gold market participants are currently eyeing at. Gold on MCX is also trading with negative bias on Monday and all strategic position should be hedged properly,” said Sandeep Matta, founder, TRADEIT Investment Advisor.

“Gold and silver prices were lower in midday US trading on Friday on some follow-through selling pressure from sharp losses seen on last Tuesday. A higher US dollar index this week is a negative outside market force working against the metals,” said Amit Khare, AVP, research commodities, Ganganagar Commodities Ltd.

Silver is down again

On the contrary, silver was trading on the slightly lower side on September 13 and again almost came down below Rs 63,000/kg level. The white metal was down by Rs 306/kg in early session and traded at Rs 63,056/kg. Silver was trading at Rs 63,362/kg on last Thursday.

“Gold and silver showed a downward movement in last couple of trading sessions. On the Multi-Commodity Exchange (MCX), October gold and silver both contracted by 0.75%. We have seen some profit booking in gold and silver since the last three-four trading sessions. Now the technical charts are again showing some short covering rally in bullion. So, traders are advised to create fresh buy positions in gold and silver in small dips near given support levels,” added Khare.