Here's what your asset allocation strategy for FY22 should look like

Depending on individual risk-taking ability one can look at investing in equities for 8 years, Gold for 6 years and Debt/Fixed income for a period of 3 years.

As we have entered a new financial year, it is the appropriate time to draw up a financial plan now. Many experts are of the view that drawing up a financial plan at the beginning of the financial year enables an individual to achieve his or her financial goals.

As Indians, we are smart at cutting corners and saving money. But when it comes to investing many of us lack in it. The first towards investing is ideal asset allocation that helps in generating optimal risk-adjusted returns. Asset allocation refers to the way in which one weighs diverse investments between equity, debt/fixed income and gold to meet a specific objective. It is a simple concept that’s vital for long-term investment success.

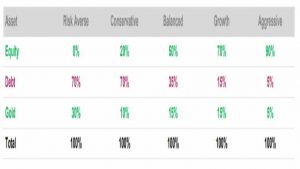

The weightage of assets in the portfolio will vary among investors depending upon their risk-taking ability. The figure below compares asset allocation strategy based on risk profiling.

Source: Axis Securities

However, experts suggest that investors should make their portfolio considering the duration of goals/objectives of investment which will also provide comprehensive suitability of the assets in the portfolio.

For example, consider that you have a goal that has to be achieved in 3 years’ time. You cant be an aggressive investor as the duration is less. The investments should be in debt instruments regardless of the investor’s risk profile.

So, it’s very important to check the duration of your goals for asset allocation in addition to risk profiling.

To aid investment decisions, Axis Securities has listed out strategies across asset classes for the upcoming financial year.

Equities: Overweight New Fiscal; New Hope!

“The fiscal year ended on a strong note for the equity markets with all the sectors delivering positive returns. This trend is likely to sustain in FY22 as well as earnings growth is expected to be robust for the broader market. Generally, during the periods of high earnings growth, mid and small caps register strong earnings growth and outperform the large caps. Asset allocation and sector rotation will be key to generate outperformance in 2021. An equity market is likely to be the best performing asset class for the next 1-2 years,” said Axis Securities.

Fixed Income: Neutral

“The slope of the yield curve has been the steepest in recent months. The difference between shorter and longer (3m, 10 year) bond yield is now at 290 bps which was 130 bps during pre-Covid times. The yield curve to remain steep given the ample liquidity in the system towards the lower end of the yield curve while the longer end of the yield curve remains elevated due to the higher supply of G-sec. We remain cautious due to inflation risk and higher crude price over the medium term,” the report noted.

Gold: Neutral

“In 2020, Gold has given 28% returns in INR and 25% returns in US$. However gold prices corrected sharply in the month of November. Gold prices are inversely correlated with bond yields. US bond yields have crossed 1.7% in the last week of March, rose by 31 bps mom & 65 bps in the last two months, now investors are betting on US inflation which could pick up early on account of an economic recovery driven by fiscal stimulus and further pick up in the vaccination program. However, gold will continue to attract investments for hedging risk against other asset class. We continue our neutral stance on Gold and recommend buy in dips strategy,” mentioned the report.

Depending on individual risk-taking ability one can look at investing in equities for 8 years, gold for six years and Debt/Fixed income for a period of three years.

(Disclaimer: The recommendations in this story are by the respective research and brokerage firm. Money9 & its management do not bear any responsibility for their investment advice. Please consult your investment advisor before investing)