Mahindra Manulife Flexi Cap Yojana: Should you invest?

The scheme will follow portfolio allocation based on a top-down approach and bottom-up stock selection

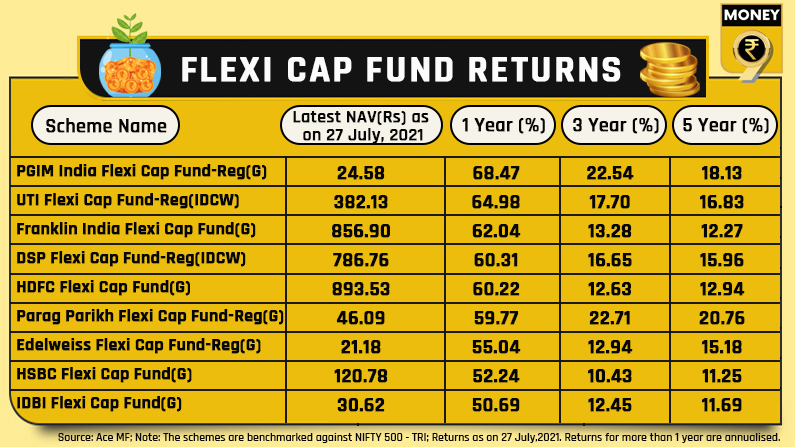

There seems no stopping the frenzy when it comes to the mutual fund companies launching Flexi funds. Under the Flexi fund, a fund manager invests a minimum of 65% of assets into equities and has permission to invest remaining assets across other market capitalisation without any restrictions. As per the value research data, the Flexi funds have given an annualised return of 51.07%, 13.38%, and 13.77% over one, three, and five years.

Mahindra Manulife Investment Management (formerly known as Mahindra Asset Management Company) recently launched a ‘Mahindra Manulife Flexi cap Yojana.’ The scheme is an open-ended dynamic equity scheme investing across large-cap, mid-cap, small-cap stocks.

Fund strategy

The scheme will follow portfolio allocation based on a top-down approach and bottom-up stock selection. The scheme has the flexibility to invest in opportunities across market capitalisation. That said, the scheme focuses on constructing a portfolio that blends core investment opportunities and tactical opportunities. The scheme will have a minimum of 65% investment in equity and equity-related instruments. The funds will be managed by fund managers Fatema Pacha and Manish Lodha.

Management views

As per the management, the scheme would invest 65% in equity and equity-related securities and will have an option to invest up to 35% in debt and money market securities, including tri-party repo, reverse repo, and up to 10% in units issued by real estate investment trusts & infrastructure investment trusts.

“The Mahindra Manulife Flexi cap Yojana is ideal for investors looking for an agile diversified fund. The fund will follow a robust internal investment framework used for determining the fair valuation of stocks which further helps in estimating valuation gaps (fair valuation vis a vis market price) if any. Opportunities are identified based on the identification of catalysts that helps bridge the valuation gaps by re-rating the stocks,” said Krishna Sanghavi, Chief Investment Officer – Equity, Mahindra Manulife Investment Management.

The management also cited that the current Indian equity markets have sustained a rally despite the second wave of the Covid-19 pandemic. The benchmark indices have doubled since the lockdown at the end of March 2020.

“The Flexi cap funds are capable of delivering steady returns across market cycles and are appreciated for their diversified approach that ensures the balance between risk and return. The flexibility to switch, if needed to mid and small-caps, which are better positioned to capture any potential upside from the expected economic recovery, make these funds well-acclaimed,” said Ashutosh Bishnoi, MD, and CEO of Mahindra Manulife Investment Management.

Flexi Cap Fund Returns Comparison

What should investors know?

-As per the management, the total expense ratio is expected to stay within the limit of 2.25%.

-There is no entry load. That said, an exit load of 0.5% is payable if units are redeemed/switched out up to 3 months from the date of allotment. However, the scheme does not attract a charge if units are redeemed/switched out after three months from the date of allotment.

-This product falls under the ‘Very High’ risk category, and investors should consult their financial advisers to check if the product is suitable for them.

-The scheme caters to the needs of investors who are actively seeking long-term capital appreciation by investing in a diversified portfolio of equity and equity-related securities across market capitalisation.

-The minimum amount of investment is Rs 1,000 and in multiples of Rs 1 thereafter.

-The new fund offer opens on July 30, 2021 and closes on August 13, 2021.