Guaranteed income plans — Should you invest in these insurance policies?

Bank fixed deposits have been giving an average return of 5.4% at a time when rising prices of goods and services are increasing at rapid pace. With fixed deposits earning a negative real return, do guaranteed return investment plans from life insurance companies give you an advantage over fixed deposits? Guaranteed return insurance policies are […]

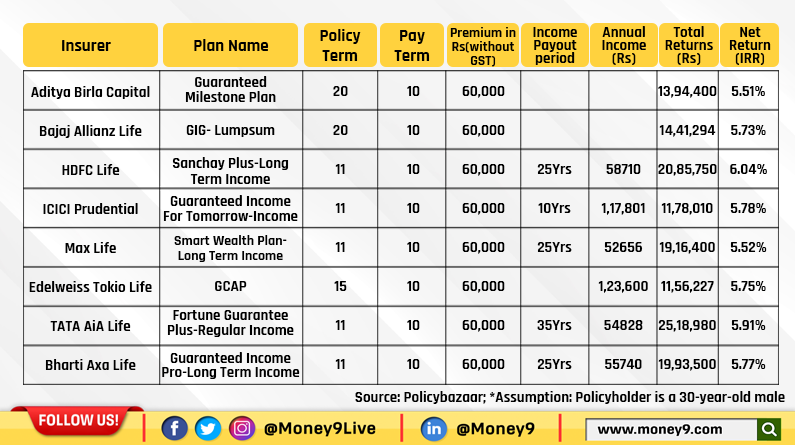

Bank fixed deposits have been giving an average return of 5.4% at a time when rising prices of goods and services are increasing at rapid pace. With fixed deposits earning a negative real return, do guaranteed return investment plans from life insurance companies give you an advantage over fixed deposits? Guaranteed return insurance policies are investment plans offered by life insurance companies which in lieu of premiums paid for a certain number of years, offers a guaranteed benefit for a fixed term. Here is a lowdown on guaranteed return investment plans and should you invest in them:

Types of guaranteed plans

These non-participatory plans, instead of declaring bonus that may vary depending on the profits that insurers make, offer a guaranteed return at the maturity of the policy. As per market reports, the maximum returns that most banks are offering for a 5-year fixed deposit is between 5 per cent – 5.5 per cent. However, the rate of returns on guaranteed returns products could be as high as 6 per cent.

There are generally two types of guaranteed return insurance plans — lump sum and income benefit plan. Under the lumpsum option, you pay a premium for a fixed term and then on maturity you are paid the guaranteed amount as an enhanced sum assured. The maturity benefit can be anything between under 200-300% of the sum assured depending on the policy term and premium paying term chosen by you.

If you choose an income benefit policy then on the maturity date, a guaranteed payout will be paid in yearly, half-yearly, quarterly or monthly instalments, as chosen by you at the inception of the policy. Generally, after the premium paying term, there is a gap of a couple of years before guaranteed payouts start, which can go for as long as 25-30 years. For example, HDFC Life Sanchay Plus -Long Term Income offers a guaranteed income for a fixed term of 35 years with a premium paying term of 5 years. The payout starts from the end of the sixth year.

There are also plans that offer capital protection by returning the premium at the end of the payout period.

Should you invest in guaranteed plans?

Before investing in these policies, always ask your agent about the net return or Internal Rate of Return (IRR ) of the policy. The percentage shows the net return you will earn annually on the policy after deduction of charges.

Vivek Jain-Head, Investments, Policybazaar.com, says, “In fact, this is happening for the first time in 21-years that the rate of returns on guaranteed returns/traditional products is much higher than returns offered by bank fixed deposits. Moreover, the structure of the guaranteed return plans is not the same across insurers and customers have a wide array of payout options to choose from. When planning to invest in guaranteed return plans, it is always suggested to buy online as a few guaranteed plans sold online promise extra maturity benefit to the customers in comparison to offline products.”

Shweta Jain, founder and CEO of Investography agrees, “When we compare FDs to guaranteed insurance plans today, insurance seems to be a better option especially if these are long term investments. The benefit of tax-free maturity gives insurance a huge edge. One should ensure that they go with eyes open, as insurance will be annual payment, whilst FDs would be one time, so they should ensure they make regular premium payments. People in the higher tax slabs benefit the most. Also, FDs beyond 5 lakhs is not insured, this has got more noticed than before and for good reason.”

“While there may be some banks/ NBFCs offering higher returns, we don’t recommend taking higher risks in a product like FDs which are opted for due to the safety aspect. However, keep an eye on inflation as that may defeat your purpose. So, if you’re saving for a long term goal, keep a combination of debt and equity- Insurance could be your debt component here rather than FD,” said Jain.

Death Benefit

If the policyholder doesn’t survive the policy term then the sum assured is paid as on the date of death. For example, under HDFC Life -Sanchay Plus Long Term Income, if the policyholder dies during the term of the tenure then death benefit under the plan is the highest of 1) 10 times the annualized premium, 2) 105% of Total Premiums paid 3) Premiums paid accumulated at an interest of 5% p.a. compounded annually, or 4) Guaranteed Sum Assured on Maturity, or an absolute amount assured to be paid on death, which is equal to the Sum Assured. Here the sum assured is equal to the applicable death benefit multiple times the annualised premium. Multiple is the range of 10-15 times. The death benefit may vary from policy to policy.