How to revive inactive PPF account?

The current interest rate on the PPF is 7.1%, making it one of the government-backed high-yielding modest savings schemes

- Himali Patel

- Last Updated : August 4, 2021, 18:42 IST

When it comes to debt instruments, long-term investors have always preferred investing in Public Provident Fund or PPF. It is a long-term tax-saving investment vehicle that pays a predetermined rate of interest on the amount invested each year and comes with a 15-year lock-in period.

Interest earned on a PPF account is tax-free, and the amount deposited during the fiscal year can be claimed under Section 80C. The current interest rate on the PPF is 7.1%, making it one of the government-backed high-yielding modest savings schemes.

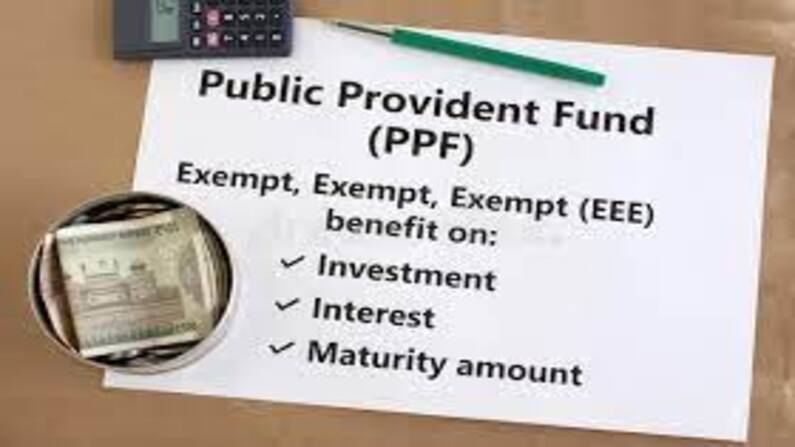

Individuals can open a PPF account with a maximum deposit of Rs 1.5 lakh and a minimum initial deposit of Rs 500. PPFs are designated as EEE (Exempt, exempt, exempt), meaning that the deposit amount, interest generated, and maturity amount are tax-exempt, making them more attractive to debt-oriented investors.

“PPF (Public Provident fund) is one of India’s favorite investment options, regardless of stringent lock-in restrictions. It’s a savings and investment scheme managed by the government. It is a viable option for people who want to build a retirement corpus without taking any risks. It helps you build a pool of savings through small amounts, safety coupled with Tax Benefits,” said Sandeep Bhosle- VP- Customer Interaction, Quantum AMC. Apart from the benefits described previously, a PPF account can become inactive if specific rules are not followed.

Let us look at why a PPF account becomes inactive and how to restore it:

1. If you do not make the annual contribution of Rs 500, your PPF account will be categorised as “inactive.”

2. It is recommended that you deposit Rs 500 by March 31 of each fiscal year cycle to maintain an active PPF account.

3. Depositors having inactive or dormant accounts will be unable to use withdrawal and loan capabilities.

4. If a PPF account is inactive, the year’s total deposit must also include deposits made in previous financial years’ default years.

5. Inactive PPF accounts cannot be extended. However, after reactivating a PPF account, the depositor may continue to make deposits and withdraw one time per fiscal year, up to a maximum of 60% of the balance at maturity in a five-year block.

6. A discontinued account may be reopened during its maturity period for a fee of fifty rupees plus five hundred rupees in arrears in minimum contribution for each year of delinquency.

7. The outstanding or remaining balance in a discontinued account that the depositor does not reinstate prior to the account’s maturity date continues to earn interest at the scheme’s then-current rate.

8. A discontinued account holder will be prohibited from opening a new account until the discontinued account matures.

9. To reactivate an inactive PPF account, the responsible account holder must submit a written application to the bank or post office where the account is located. A PPF account may be reactivated at any time during the account’s or scheme’s 15-year tenure.

Download Money9 App for the latest updates on Personal Finance.

Related

- पहली छमाही में रियल एस्टेट में संस्थागत निवेश 37% घटकर तीन अरब डॉलर रहने का अनुमान

- Budget’24: New LTCG rule to hit long-term property owners hard

- Looking to buy gold? Buy now before it’s too late!

- Budget 2024: What is NPS ‘Vatsalya’ scheme? How to apply & other benefits?

- Budget’ 24: Startup ecosystem all smiles with scrapping of angel tax

- Budget’24: New NPS scheme for minors launched, here’s how you can benefit