Should you include value funds in your portfolio?

Value funds are invested in equities and thus, the earnings and risks are similar to those of equity funds

Market experts believe that the right share value is very important in its purchase. It is generally believed that if the shares are trading at a price lower than their value, they have the potential to give big returns in future.

When markets crashed last year during March-April, majority of experts advised on buying in companies with good value. As a result, good quality companies recovered quickly.

But how do you know this value? How to know when you are buying a stock whether it is at the right value or not. There are many parameters to decide this, but if you to leave this solely on mutual funds, then the category for this is value funds.

Value funds invest in stocks that are trading below their value as per the fund house. These are the companies which have huge potential for further growth.

Expert view

Nisha Sanghvi, co-founder and CFP of ProMore Fintech, said investors have to devote time to earn from these funds.

She recommends investing in these funds only if one can sustain their investment for more than seven years. “Since these funds are cyclical in nature, they have less earning potential in the short term. A value cycle takes at least five to six years to turn. Then you will see good returns,” Sanghvi said.

Performance

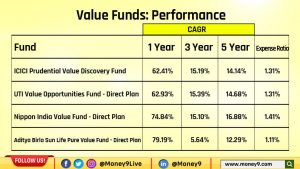

Value funds are invested in equities and thus, the earnings and risks are similar to those of equity funds. Most of the funds in this category have given returns of 60 to 80% in a year. However, while looking at the returns of one year, note that these returns are on the basis of recovery from the record fall caused due to the outbreak of Covid-19 in 2020 and a subsequent nationwide lockdown. In the last five years, these funds have given returns of 12 to 17%.

Nippon India Value Fund – Direct Plan has given returns of 16.88% in 5 years and 15.10% in seven years. If you had invested Rs 1 lakh in this fund seven years ago, then this amount would have touched Rs 2.68 lakh today.

On the other hand, ICICI Prudential Value Discovery Fund and UTI Value Opportunity Fund have given similar returns. In the last 5 years, both these funds have given returns in the range of 14-15%.

Funds sold under the name Contra are also included in the same category as value funds. These include Invesco India Contra Fund and Kotak India Equity Contra Fund. Invesco India Contra Fund has given a return of 18.24% over a period of 7 years. This means, a lump sum investment of Rs 1 lakh made seven years ago would have increased to Rs 3.23 lakh and the value of SIP of Rs 10,000 every month started seven years ago would have reached Rs 15.65 lakh as on today.

Not for risk-averse investors

In the category of value funds, most of the funds have higher allocation in financial, healthcare and technology stocks. Sanghvi advises investors to include these funds in the portfolio only if they are willing to take risks and are patient . If you have a habit of constantly checking the NAVs, then stay away from these funds.

“Many fund houses come up with this category of close ended funds that should be avoided since the tenure of many such funds is only three years and investing in lump sum in such a short span of time would not yield huge returns. While choosing a value category fund, keep these things in mind and be cautious,” Sanghvi asserted.

Tax deduction

These funds attract capital gains tax similar to the equity category. If the investment is withdrawn for a period of less than one year, then the total profit will be taxed at 15%. If you withdraw money from the fund after one year, then 10% long term capital gains tax will be levied on profits exceeding Rs 1 lakh. The dividend income will be added to your income and taxed as per your tax slab. If the dividend earned in a financial year exceeds Rs 5,000, the fund will deduct 10% TDS.