SIP top-up: Should you opt for it?

The top-up could either be a percentage of your existing SIP amount, for instance, 10%, or it could be multiples of a minimal amount as defined by the mutual fund

The term SIP or Systematic Investment Plan is no longer a new thing for many of us. Mutual funds offer this facility to investors wherein they can invest their savings in a disciplined way in fixed amounts at pre-defined intervals in any mutual fund scheme of their choice.

Now, we are aware that the amount can start from Rs 500 and the pre-defined intervals could be a weekly/monthly/ quarterly/semi-annually or annual interval. However, there is another aspect of SIP that we need to look into — SIP top-up.

What is the SIP top-up facility?

Under this facility, the investor can increase his/her amount of SIP installment at the pre-defined intervals, either annual or half-yearly. The top-up could either be a percentage of your existing SIP amount, for instance, 10%, or it could be multiples of a minimal amount as defined by the mutual fund, for example, multiples of Rs 500.

Also Read | Money9 Initiative: Experts highlight importance of micro-SIPs

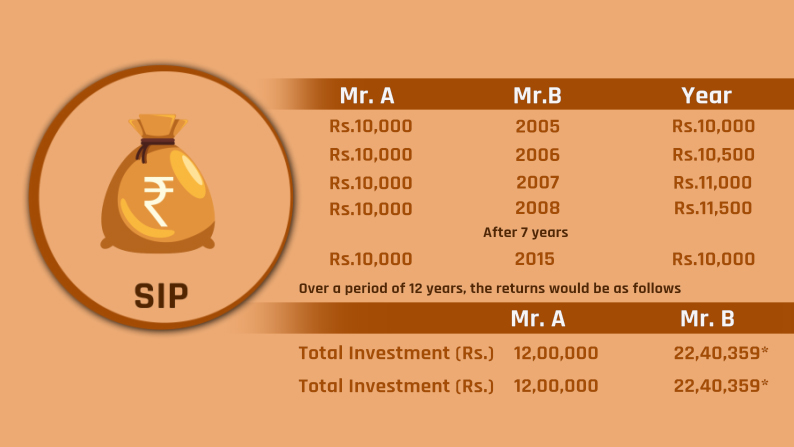

Mr. A and Mr.B had begun their investment in a certain equity mutual fund scheme in the year 2005, the installment amount being Rs.10,000. Mr. A kept investing a fixed amount of Rs.10,000 every year for 10 years. However, Mr.B started increasing his installment amount by Rs.500 every year.

Their annual investments would look as below:

*The SIP returns are calculated using the XIRR approach, assuming an investment of Rs.10,000 @ 12%, on the 1st working day of every month, compounded annually.

** The SIP top-up returns are calculated using the XIRR approach, assuming an investment of Rs.10,000 @ 12%, on the 1st working day of every month for the 1st year, with an annual increase of Rs.500 in the amount of SIP, compounded annually.

This simple example is self-explanatory as to how a top-up of just Rs 500 makes an exorbitant difference in an investor’s accumulated wealth.

Also Read: SIP or Lumpsum? Ace fund manager Nilesh Shah draws ‘Kumbhakarna’ analogy

Furthermore, the upper limit for capping the top-up can be indicated by the investor, which could be either the month and year or the amount. When the pre-defined cap is reached, the top-up will stop. However, the SIP continues for the tenure, with the installment being at the capped level. When an investor opts for the SIP top-up option, no changes can be made and in case they feel their income doesn’t support the regular top-ups, then the investor will have to cancel the SIP.

So, the benefits of a SIP top-up can be summed up in the following points:

— A SIP top-up will adapt to the rise in income – Every year, an employee would expect a bonus/increment from employers and this additional amount could be invested into the SIP as a top-up.

— A SIP top-up helps attain financial goals faster – A SIP has been created in a manner that helps an investor to attain his/her long-term financial goals. Furthermore, opting for a SIP top-up will enable the investor to achieve these goals faster or even expand the goals to match their requirements.

— A SIP top-up helps combat inflation – Inflation can cause the value of money to come crashing down and this makes investors opt for making an increment in their contributions towards their investments. This enables them to be well-prepared for any long-term crisis.

— A top-up will help you stay invested in one plan – When you opt for a SIP top-up, you need not invest in multiple SIPs. If you have an increase in income or procure extra income by way of a bonus or any other means, you can systematically invest the amount via a top-up in your existing scheme instead of looking for some new investment options, which can be quite time-consuming.

Conclusion

A Systematic Investment Plan is a great way of having a disciplined investment that will take care of your long-term financial goals. Furthermore, mutual funds also offer top-up facilities to their SIP schemes which offers convenience to the investors.

By opting for a top-up facility you can increase your target corpus, thereby, enabling you to not just follow a disciplined investment but also have a flexible one. A top-up option will adapt itself to any changes in your financial circumstances and will help in attaining the financial goals much faster. A top-up facility not just helps an investor tackle an issue like inflation but also enhances financial reliability and helps in dealing with unpredictable contingencies in the future.

(The writer is co-founder and CEO, Moneyfront. Views expressed are personal)