SWP in debt funds: Tax-efficient investment option for retirees

While SWP in debt funds is much more tax efficient, a fixed return is not guaranteed

Regular cash flow is more important than higher returns for retirees. While fixed deposits are the prime choice for most retirees to receive regular cash-flow in the form of interest income, there is another that senior citizens may consider – debt fund investment with systemic withdrawal plan (SWP).

All you have to do is put a lumpsum amount in a safer debt mutual fund and give a mandate for SWP. This will ensure you receive a pre-determined sum from your mutual fund at an interval chosen by you. This could be weekly, monthly, quarterly, semi-annually, or annually.

Why choose debt funds with SWP over FDs

One should not make an investment without tax consideration. Debt fund with SWP gives you better post-tax returns compared to fixed deposits, especially when you are in the higher tax slabs.

The interest income on fixed deposits is taxed as per the income tax slab, i.e., at 20 per cent or 30 per cent. The short-term (if redeemed before three years) capital gains in debt mutual funds are taxed as per the slab rate, while long-term capital gains are taxed at 20% with indexation.

Even though FD interest income and withdrawals in debt funds are both taxed as per the slab rate, there is an additional advantage when doing SWP in debt funds.

“In case of fixed deposits, only the interest component earned is paid-out to the depositors through monthly or quarterly pay-out proceeds. Hence, the entire amount withdrawn through the pay-out options becomes liable for taxation,” says Sahil Arora – Senior Director, Paisabazaar.com.

“In case of SWPs in mutual funds, it is the units that are redeemed and not just the capital gains generated. Hence, the redemption proceeds would consist of both principal/investment component and capital gains component; and the tax liability will arise only on the capital gains component. Thus, the tax liability would be lower for the one opting for the mutual fund SWP to generate regular income,” Arora adds.

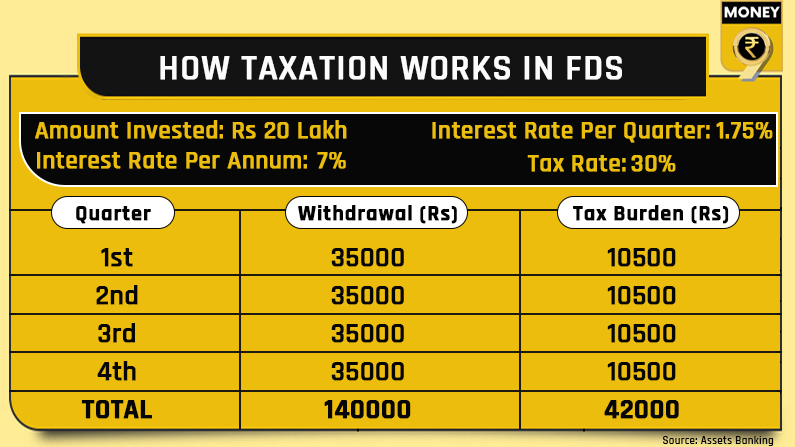

Let’s understand with an example:

Suppose you invest Rs 20 lakh in an FD at 7% interest rate per annum. If you opt for quarterly pay-out, you will receive Rs 35,000 each quarter. If you are in the tax bracket of 30%, your tax liability each quarter will amount to Rs 10,500, totalling Rs 42000 for a year.

If you invest the same amount (Rs 20 lakh) in a debt mutual fund at an NAV of Rs 40, you will receive 50,000 units. Assume the debt fund will give 7% returns per annum (1.71% per quarter). It means the NAV will grow to Rs 40.68 after a quarter. If you opt for quarterly withdrawal of Rs 35,000, you will be redeeming 860.32 units (35000/40.68) in the first quarter. Since only capital gains component will get taxed, which is Rs 0.68 (40.68-40) per unit, the value of your capital gains will be Rs 587.03 (860.32*0.68). The tax on the same at 30% will amount to Rs 176.11. The same exercise will happen for the next three quarters. The yearly capital gains will amount to Rs 5,772. The tax liability will come in at Rs 1732, much lower than Rs 42,000 in case of FDs.

The difference will be even higher when capital gains turn long-term, and are taxed at 20% with indexation in case of SWP in debt mutual funds.

The advantage in FDs, however, is the exemption on interest income. “There is a tax exemption of Rs 50,000 per annum for senior citizens under section 80TTB of Income-Tax Act. However, it includes overall interest earned by saving accounts, all ongoing FDs and recurring deposits,” says certified financial planner Ramesh Agarwal who is a director at Assets Banking.

Know the risk

While SWP in debt funds is much more tax efficient, a fixed return is not guaranteed. The interest rate on FDs doesn’t vary. It is fixed for the entire tenure.

Focus on interest rate cycle. If you expect interest rates to go down from the current levels, lock in the existing higher rate with FDs. In rising interest rate scenario, short-term debt funds with 1-3-year Macaulay duration will be better. Macaulay duration tells you how long it will take to get back your invested amount in terms of periodic interest and the principal repayment.

One needs to be mindful of credit risk in debt funds too. It is advisable to stick to debt funds investing in AAA-rated instruments.

“Senior citizens are getting smart nowadays. They are investing in debt funds opting for SWPs. But they should be aware of credit risk and interest rate risk in such funds. Diversifying between FDs and debt funds will work the best for senior citizens,” Agarwal adds.