Taxpayers now need to file a quarter-wise breakup of the dividend income

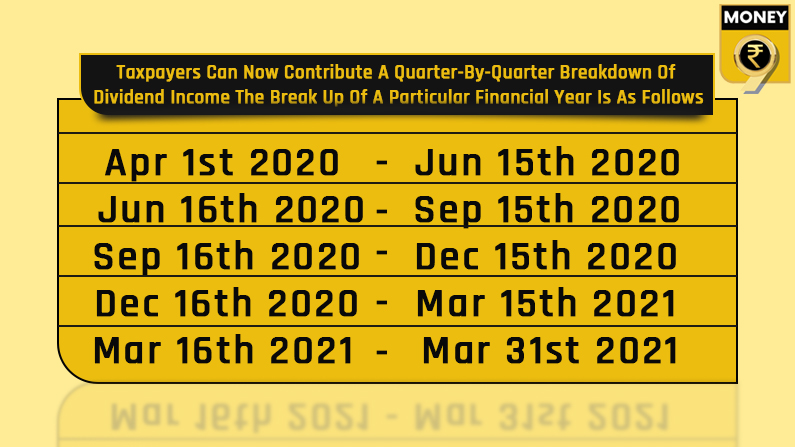

Taxpayers can now contribute a quarter-by-quarter breakdown of dividend income that is received in a particular financial year

One of the significant amendments made in the Finance Act 2020 was an overhaul of the Dividend Taxation regime, wherein the erstwhile exemption (up to Rs. 10 lakhs) on dividends in the hands of shareholders was withdrawn. The said income was subjected to tax in the hands of the assessee under section 56(2)(i) of the Income Tax Act, 1961 (‘IT Act’).

Before fiscal year FY21, dividend income of up to Rs 10 lakh was not taxable in the hands of taxpayers since firms were required to pay dividend distribution tax (DDT) prior to making dividend payments.

However, individuals who received dividends over Rs 10 lakh used to pay only 10% tax on the dividend amount. However, beginning in fiscal year FY21, the government made dividends distributed by a fund house taxable in the hands of investors.

To calculate interest for default in payment of advance tax liability, the taxpayers would be required to provide a quarter-wise break-up of the dividend income in their Income Tax returns to claim relief on the interest calculation regarding advance tax payments.

“Under the erstwhile Dividend Tax regime, dividend over Rs 10 lakhs was subject to tax @ 10%, and as such, ITR-2 and ITR-3 already had cells to report dividends quarterly. Thus, the CBDT amended “Schedule Income From Other Sources” for ITR-1 and ITR-4. As per the ITR Forms, taxpayers earning dividend incomes are required to give a quarterly disclosure in their ITR’s,” pointed out Suresh Surana, founder, RSM India. Reporting quarterly is mandatory to claim relaxations of interest exposure on payment of advance tax on dividend income. (See the table: The quarterly disclosure dates).

“Non-compliance of this attracts penalty under section 234C of the IT Act. Since the dividend incomes are made taxable, taxpayers are under an obligation to pay advance tax on the dividend incomes received every quarter. Thus, quarterly reporting of these dividend incomes help determine the appropriate interest liability u/s 234C, as interest provisions would be applicable only from the quarter in which dividend is received and not for the earlier quarters,” explained Suresh Surana, founder, RSM India.

How will this impact the taxpayer?

From now onwards, to curb delinquency in settlement of the advance tax due, taxpayers can now contribute a quarter-by-quarter breakdown of dividend income that is received in a particular financial year, believes financial experts.

“The point here is that this move is a relief of immense significance for the people determining the interest due for the failure to pay an advance tax due that is levied under section 234C of the Income Tax Act 1961. In essence, these quarterly dividend breakups could be a relief for the taxpayers in general in addition to relief to tax machinery of the government,” said Amit Gupta, MD, SAG Infotech. Moreover, If the company deducts tax when issuing dividends, a person can claim TDS credit on their income tax return. Nevertheless, the income tax department has also made it mandatory for the taxpayers to pay the advance tax in the quarter they received the dividend income.

“If your ITR has pre-filled data, it is a smart move as one can in a single go double-check the details before finalizing his income tax return. However, concurrently, taxpayers should not also forget the fact that they should take the initiative to file their income tax returns (ITR) for the fiscal year 2020-21 from as early as July 1. (FY21),” said Gupta.