UTI Focused Equity Fund: Should you invest?

UTI Focused Equity Fund will identify stocks from the bottom-up approach and will invest in both growth and value stocks

As an investor, if you want to bet on a fund that holds lesser companies with the sole purpose to generate an alpha return then a focused mutual fund is for you. A focused fund is a mutual fund that invests in a small number of companies that are similar in some characteristics.

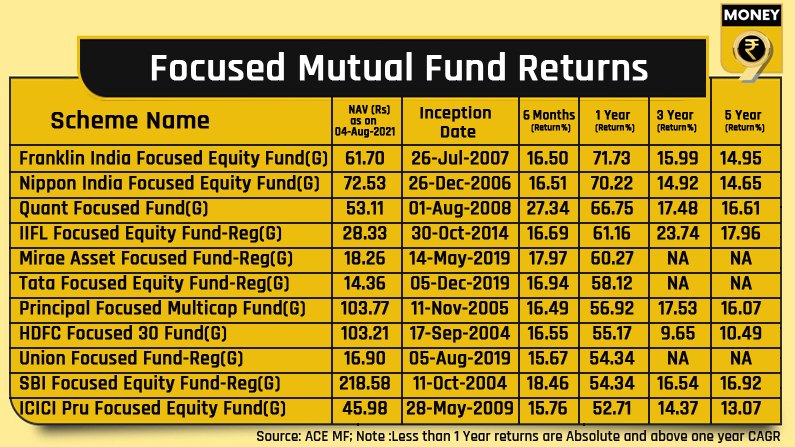

By definition, a focused mutual fund invests in a small number of stocks rather than a diverse portfolio of securities. In comparison to many funds, which have investments in well over 100 firms, focused funds typically maintain positions in between 20 and 30 companies. However, those investors who are willing to take a high amount of risk should consider these funds, as this fund portfolio lacks diversification and chooses to focus only on certain companies. Historical these funds have given returns of over 70% in one year and 18% in five years.

Recently, UTI Mutual Fund launched an open-ended equity scheme dubbed the ‘UTI Focused Equity Fund’. The fund will invest in a maximum of 30 stocks across market capitalisation. The new fund offer opens on August 04, 2021, and closes on August 18, 2021. The scheme will re-open for subscription and redemption on an ongoing basis from August 26, 2021.

Investment objective

The scheme’s investment aim is to achieve long-term capital appreciation by investing in equities and equity-related securities representing a maximum of 30 stocks with varying market capitalizations. However, there is no assurance or guarantee that the scheme’s investment objective will be met. The fund is benchmarked against the Nifty 500 Index (TRI).

Management view

UTI Focused Equity Fund will identify stocks from the bottom-up approach and will invest in both growth and value stocks, with a preference tilted more towards growth stocks. The Fund seeks to maintain an optimal level of diversification by investing across sectors and market capitalisation. The fund would be managed by Sudhanshu Asthana, who is the fund manager.

“Focused investing is all about high conviction and our philosophy has two dimensions to generate portfolio alpha. The first is to hand-pick a select set of companies from the larger universe by relying on our score alpha investment philosophy aided by rich experience in research and fund management to separate the wheat from the chaff. Second is to build the portfolio to demonstrate the conviction by building significant portfolio positions in each company, which may accentuate the portfolio outcome,” said Sudhanshu Asthana.

“UTI Focused Equity Fund will endeavour to build a concentrated portfolio of up to 30 select hand-picked high-conviction ideas. The core portfolio will be built with stocks having the potential of long-term sustainable growth. A portion of the portfolio will be invested in transformational opportunities; where strategy will be realigned to make the outcomes more sustainable and will also pick undervalued cyclical opportunities and benefit from mean reversion” he added.

What should investors know?

-Residents, non-resident Indians, institutions, banks, eligible trusts, financial institutions, and foreign portfolio investors (FPIs) are all eligible to participate in the scheme.

-The maximum total expense ratio (TER) permissible is up to 2.25% as per the Sebi guidelines.

-During the NFO period, the scheme’s units will be sold at face value, i.e., Rs 10 per unit.

-The minimum initial investment is Rs 5,000, and subsequent investments can be made in multiples of Rs 1 with no upper limit. Additional purchase amount Rs 1,000 and subsequently in multiples of Rs 1 with no maximum limit.

-There is no entry load and if you exit within the year it will attract an exit load of 1%. No exit load would be applicable if you exited the scheme at or after one year of the unit’s allotment.

-The scheme falls under the ‘Very High’ risk category, and so investors should consult their financial advisors to check the suitability of the product.

-The scheme offers the regular and direct plans. Both the plans offer growth and payout of income distribution cum capital withdrawal options.