What are the tax benefits for first-time homebuyers?

Overall, a user can claim up to Rs 5 lakh deductions being first-time home buyers and home loans taken for the same

Buying a home is a big task, and if you are a first-time homebuyer, a lot depends on your understanding of your cash flow, what is essential and how early you would like to buy it. That said, if you are a first-time home buyer in 2021, you are entitled to get income tax benefits on your home loan.

On availing of a home loan, monthly repayments comprise two components of the loan – principal, and interest. The income tax act ensures tax benefits on both these components.

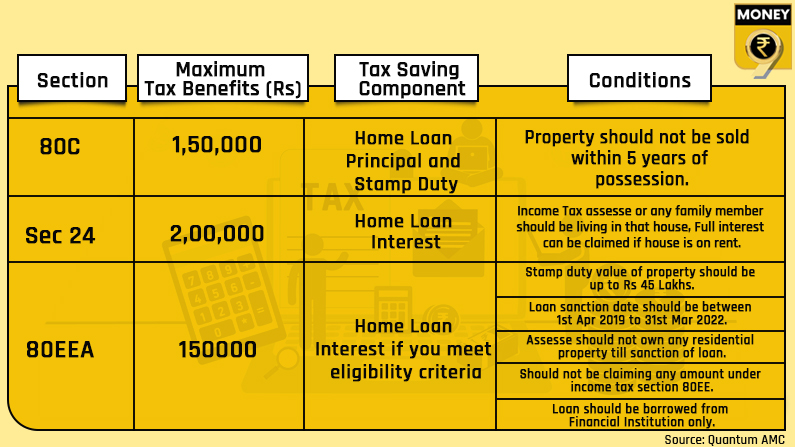

“First-time homebuyers are eligible to avail income tax benefits on their loan under three sections – Section 80C, Section 24 and Section 80EEA of Income Tax Act. All these sections of the income tax act provide maximum tax rebate of Rs 5 lakh annually,” said Pramod Kathuria, Co-Founder & CEO, Easiloan. (See the Table)

What are the terms and conditions to avail tax benefits under section 80C?

Under this section, the deduction is available up to Rs 1.5 lakhs for the principal repayment of the home loan repaid during the year.

To avail of the tax-saving component under section 80C, construction of the property first should be completed to claim benefits under Section 80C. Further, the property should not be sold within five years of possession.

“If you sell your house within five years after possession, any deduction claimed will be reversed in the year in which it is sold. This amount will also be added to the income for the sale year,” said Kathuria.

What are the terms and conditions to avail tax benefits under Section 80EEA?

The taxpayer can claim an additional deduction of up to Rs 1.5 lakhs for the interest paid on a home loan subject to fulfilment of certain conditions.

Under this section, the stamp duty value of the property should be up to Rs 45 lakhs, and the loan sanction date should be between 1 April, 2019 to 31 March, 2022.

This deduction is in addition to the deduction of Rs 2 lakh for interest payments under Section 24 of the Income Tax Act.

What are the terms and conditions to avail tax benefits under Section 24?

Under section 24, the amount of Interest accruing on home loans up to Rs. 200,000/- can be claimed as a deduction for every tax period if the house property is self-occupied by the assessee. If the property is rented out, full interest paid can be claimed as a deduction. But the loss under house property income shall only be allowed to be set off against other income up to Rs2 lakh every year and the excess loss shall be carried forward for set-off against house property income in the next eight years.

“It is notable that if the deduction for interest is claimed u/s 80EEA, then such amount of interest (or such part of the interest payment) cannot be again claimed as deduction under section 24. For instance, say the interest on a housing loan is Rs 350,000, then in that case deduction u/s 24 would be Rs. 200,000 and u/s 80EEA would be Rs. 150,000. The amount of interest accruing on a home loan up to Rs 2,00,000 can be claimed as a deduction for every tax period under section 24 of the IT Act if the house property is self-occupied by the assessee,” said Surana, founder, RSM India”, RSM India.

Apart from the above income tax benefits, there are few more benefits are available if a woman buys a home. Though there are no specific benefits in case, a woman buys a house. She can claim all the above-mentioned benefits under income tax laws like a man.

“Some state governments have given 1%-2% benefit of stamp duty if the woman is the owner of the house. If both husband-and-wife purchase house jointly, the income tax benefit rules remain the same in that case; however, both husband and wife can claim tax benefits in their individual files appropriately,” said Sandeep Bhosle, Vice President- Customer Interaction, Quantum AMC.

How can you plan to save money for home buying?

Financial experts advise you to start saving early. For many individuals, home buying is the common goal. One should start planning as early as possible to buy the house. One must decide the timing for buying the home.

“He/she can decide a budget for buying a home, and considering the inflation rate, he/she can start to invest the amount of savings. He/she should also plan the amount to be financed and the amount to be paid by themselves. For example, at the age of 25 or 7 years from now, you can buy a home and start planning accordingly,” said Abhishek Soni, CEO & Co-founder, Tax2win.in.

Starting early enables you to get compounded investment benefits over the period of investment you may invest in mutual funds through systematic investment plans, recurring deposits, or any such instrument.

“Early-stage liabilities are limited, and saving potential is higher. With a planned and disciplined approach, you can save the required sum as may be required as a contribution from the buyer,” said Kathuria.

When planning to buy a home, taking assistance from the home loan is not wrong, but taking a loan even to pay the down payment is a sin, so planning is essential for the down payment. “While saving for the down payment, do not forget to save for the additional expenses like registration fees, loan application fees, and moving charges,” warned Manish Hingar, Founder of Fintoo.

Choosing to purchase also needs several months off from your investment. It clearly separates the price that you require for your down payment by the period of months left. “If one is preparing to get a home loan, the law of thumb is to use no higher than 25 percent of his net salary in lieu of the loan amount,” agreed Amit Gupta, MD, SAG Infotech.

One should also not ignore the additional expenses you’ll have to pay, such as registration and stamp duty fees, interiors, and maintenance fees, among others. This will help you know your targets and make it easier to plan for them.