These schemes can help women get ample return along with capital security!

A new nationwide study conducted by HelpAge India, which surveyed 8,000 women over 65 years of age, noted that 3 out of every 4 women do not have any financial cushion or savings to their name.

It’s no secret that women generally outlive their male counterparts. A recent Harvard study established that globally, women tend to live an average of 7 years longer than men.

However, that also implies that women end up bearing greater challenges, particularly when it comes to living through their sunset years. Their physical and emotional turmoil is definitely exacerbated by their unending financial woes.

Growing elderly women; lacking financial awareness:

A new nationwide study conducted by HelpAge India, which surveyed 8,000 women over 65 years of age, noted that 3 out of every 4 women do not have any financial cushion or savings to their name.

About 80% of the respondents relied on their children for financial support. And, while, that might sound reassuring, the same report also underlined how 16% of them faced physical and mental abuse at the hands of their children during the twilight years of life.

Worse still, an overwhelming majority of those surveyed, around 78%, are not cognizant of a single government or social security welfare scheme.

Its time to take action!

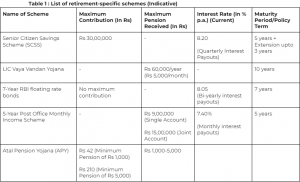

Pune-based financial planner, Sanjeev Dawar, lists out some viable investment options that senior citizens can opt for. This would enable them to make their post-retirement lives comfortable. In addition to this, one can also opt for guaranteed annuity plans, AAA-rated corporate bonds or FDs to further strengthen their retirement corpus.

Dawar concludes, “Financial planning amongst senior citizens is crucial, since their funds require capital protection. Any investment option they pick should have adequate liquidity which means regular income and inflation proof returns”.