Here are the top 30 stocks that mutual funds bought and sold in June

Among largecap stocks, mutual funds bought shares of Indus Towers, Havells India, SBI Cards, JSW Steel, and Muthoot Finance.

Inflows into equity mutual funds continued, however, the pace slowed down a bit in June. According to data released by the Association of Mutual Funds in India (Amfi), the net inflow into open-ended equity schemes stood at Rs 5,988.17 crore, a drop of 41% compared to Rs 10,082.98 crore in May as investors booked profits at higher levels. However, the asset under management by the mutual fund industry increased 1.9% month-on-month (M-O-M) to Rs 33.66 lakh crore in June 2021, primarily led by an M-O-M increase in AUM of equity funds (Rs 41,300 crore), arbitrage funds (Rs 8,900 crore), and balanced funds (Rs 7,600 crore).

The contributions under the systematic investment plan (SIP) continued to break records for the second month in a row as it touched lifetime highs of Rs 9,155.84 crore in June 2021 versus Rs 8,818.90 crore witnessed in May 2021. Although the March 2021 SIP contribution stood at Rs 9,182 crore which consisted of Rs 495-500 crore of February which could not be chanelled due to the weekend.

With continuous inflows into the equity mutual fund category let’s have a look at what are their top 10 picks among large, mid & smallcap stocks

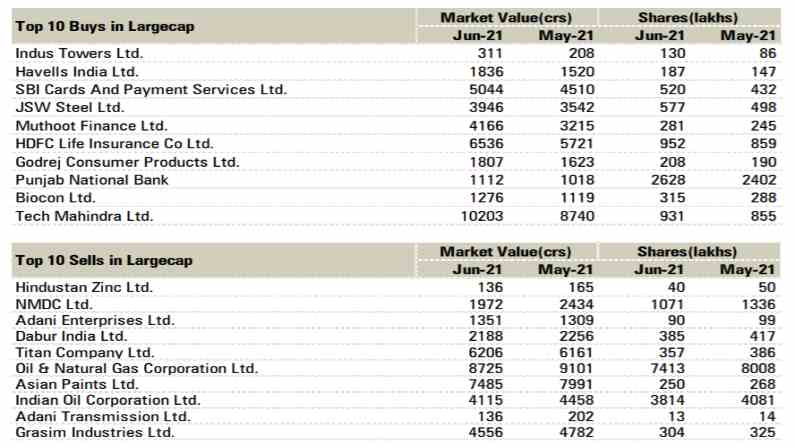

Largecap picks

Among largecap stocks, mutual funds bought shares of Indus Towers, Havells India, SBI Cards, JSW Steel and Muthoot Finance.

On the other hand, they sold stakes in Hindustan Zinc, NMDC, Adani Enterprises, Dabur India and Titan.

Source: ACE MF, ICICI Direct Research. Note: Largecaps/Midcaps/Smallcaps as defined by AMFI. Socks above Rs 50 crore holding were considered.

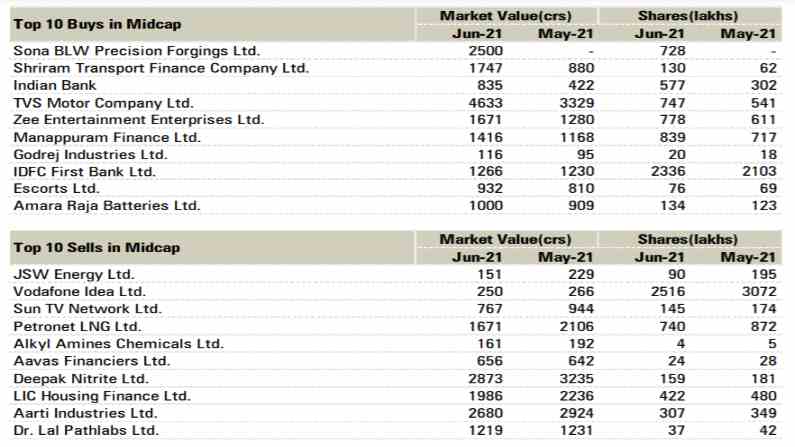

Midcap picks

In the midcap space, the highest buying was seen in Sona BLW Precision Forgings, Shriram Transport Finance, Indian Bank, TVS Motor Company and ZEE.

While companies like JSW Energy, Vodafone Idea, Sun TV Network, Petronet LNG, and Alkyl Amines were in which fund houses reduced their stake.

Source: ACE MF, ICICI Direct Research. Note: Largecaps/Midcaps/Smallcaps as defined by AMFI. Socks above Rs 50 crore holding were considered.

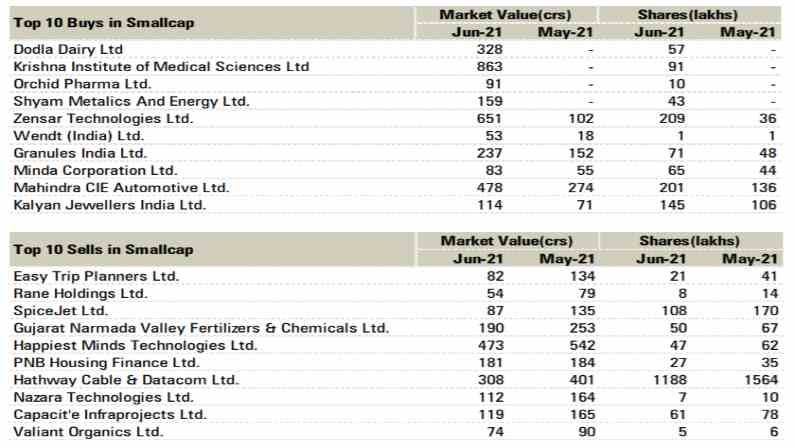

Smallcap picks

Mutual funds increased their stake in companies like Dodla Dairy, KIMS, Orchid Pharma, Shyam Metalics and Zensar Tech.

Whereas Easy Trip Planners, Rane Holdings, SpiceJet, Gujarat Narmada Valley Fertilisers and Happiest Minds Technologies were sold the most by mutual funds in June.

Source: ACE MF, ICICI Direct Research. Note: Largecaps/Midcaps/Smallcaps as defined by AMFI. Socks above Rs 50 crore holding were considered.

Download Money9 App for the latest updates on Personal Finance.

Related

- अमेरिका में लागत बढ़ने से भारत में माल भेज सकता है चीन, सरकार ने निगरानी प्रकोष्ठ बनाया

- जेनसोल इंजीनियरिंग और प्रमोटरों पर सेबी ने लगाया बैन, ये है मामला

- SEBI ने NSDL को IPO लाने के लिए 31 जुलाई तक का समय दिया

- EWFL Restructures Stock as Industry Soars

- इंडसइंड बैंक का शेयर 23 फीसदी टूटा, 52 सप्ताह के निचले स्तर पर

- एशियाई बाजारों में तेजी के बीच सेंसेक्स 564 अंक चढ़ा