Investors who exit the stock market to avoid fall may miss the next rally

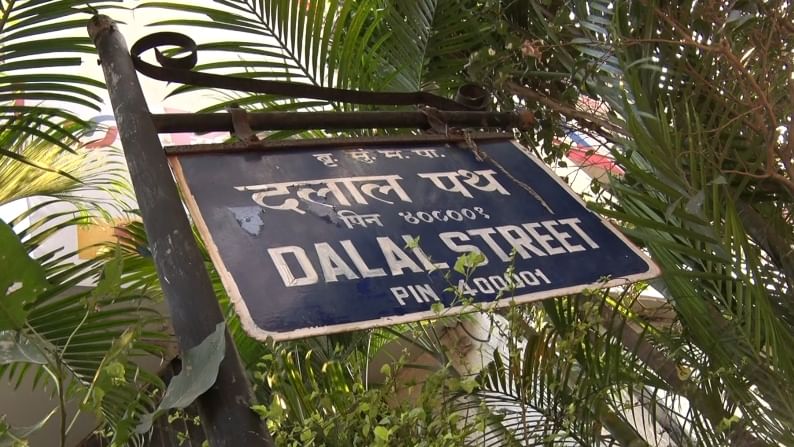

Elara Securities in a note said, the ship has just begun to sail for the next voyage amid the ongoing bull run on Dalal Street.

Markets have seen a stellar run since the past few weeks with both global and domestic bourses scaling record heights. This week was no different with Indian Indices continuing their onward march with no sign of wariness. According to Samco Securities, several factors contributed to this rally and it appeared that the existing liquidity in the market was the driving force. So far this year, funds raised through initial public offers (IPOs) have increased by almost 2.2 times compared to the previous year and 11 more companies with Sebi’s nod are slated to raise over Rs 11,600 crore.

More than 40 companies will be seeking nearly Rs 89,000 crore as they await the regulator’s approval to join the bandwagon and cash in on the abundant liquidity and enthusiasm among retail investors.

“Another aspect contributing to this inflow is the regulatory storm that Chinese enterprises are facing, which is prompting investors to look at other growing economies. All these factors collectively led Nifty50 to record its fastest sprint of 1,000 points in just 19 trading sessions,” Samco Securities said in a note.

Not only the markets but other macros also showed signs of recovery with the Q1GDP numbers rising in terms of personal consumption, exports and capex albeit on a low base, GST collections surpassing Rs 1 lakh crores for the second consecutive month and manufacturing PMI data staying in the expansionary territory from July. “This certainly is strengthening the confidence of market participants which will fuel the rally going ahead,” Samco Securities said.

Of late, Elara Securities in a note said, the ship has just begun to sail for the next voyage amid the ongoing bull run on Dalal Street. It believes that Nifty is set to hit the 19,600-mark in the medium-term and 24,400 in the long run.

Going with the flow (with caution) seems to be the most logical choice of action in a market like this as Peter Lynch said: “People who exit the stock market to avoid a decline are odds-on favourites to miss the next rally.”

Event of the week

August auto sales numbers didn’t surprise D-Street this week. Though numbers appear to be excellent on a YoY basis, on a sequential basis, passenger vehicles and tractors experienced minor headwinds while commercial vehicles performed well. Two-wheeler sales witnessed a slight slowdown due to concerns about affordability and increased competition from the EVs. What encumbered the automotive industry the most were supply-side curbs, especially the semi-conductor shortage which has further aggravated due to fresh lockdowns in East Asia. Nonetheless, the consumer demand is intact on account of the upcoming festive season and investors may strategically choose to build an exposure to benefit once these supply-side disruptions begin to fade out.