Market geared for negative start

Asian stocks are trading mixed on Wednesday as investors assessed the impact of the omicron Covid variant.

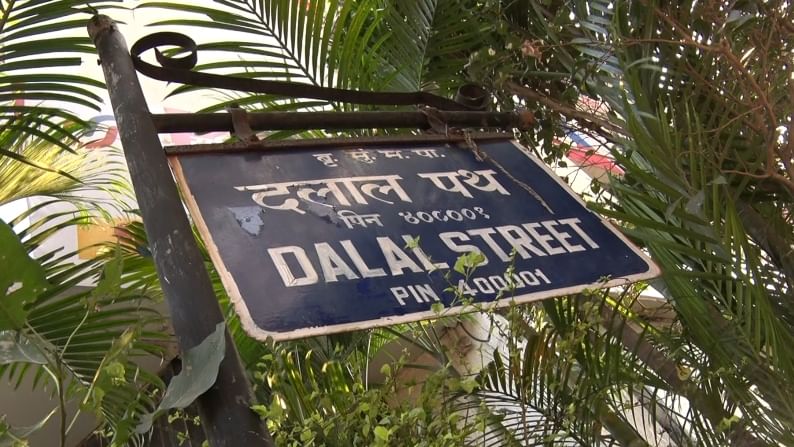

Trading of Nifty 50 index futures on the Singapore stock exchange indicates that the Nifty could fall 49 points at the opening bell. The Securities and Exchange Board of India (SEBI) on December 28 cleared the rules for tightening initial public offerings (IPOs). These rules will address gaps like conditions for the objective of IPOs, utilisation of proceeds from the share sales, price bands, anchor investors’ lock-in period and the size of the stake a majority shareholder may sell on listing day.

Global markets

Overseas, Asian stocks are trading mixed on Wednesday as investors assessed the impact of the omicron Covid variant.

A study from South Africa found the immune response of people infected with the omicron Covid variant appears to increase protection against delta more than fourfold and could displace it.

U.S. stocks were mixed Tuesday as investors continued to look to pandemic news for direction with the threat of the omicron variant looming large. The S&P 500 closed slightly lower after hitting a record intraday high on Tuesday.

Domestic markets

Back home, the domestic equity benchmarks ended with strong gains on Tuesday, tracking positive global trend. The barometer index, the S&P BSE Sensex, rose 477.24 points or 0.83% to 57,897.48. The Nifty 50 index gained 147 points or 0.86% to 17,233.25.

Foreign portfolio investors (FPIs) bought shares worth Rs 207.31 crore, while domestic institutional investors (DIIs), were net buyers to the tune of Rs 567.47 crore in the Indian equity market on 28 December, provisional data showed.