Individual investors punting through the derivatives segment

Many experts are of the view that a change in rules by SEBI to pay upfront margin even for simple buying and selling of stock may have forced some to switch to F&O segments

It seems retail investors are taking a shine towards equity investments as a record 1.42 crore new demat accounts were opened in FY21, nearly three times the figure in the previous fiscal year, according to data released by National Securities Depository (NSDL) and Central Depository Services (CDSL).

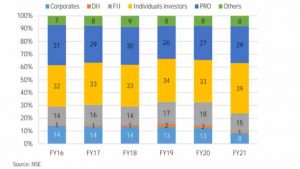

A little-known fact is that retail investors are increasingly taking the F&O route to speculate in the markets. Data released by NSE shows that the share of individual investors in index futures has gone up from 32% to 39% between FY16 and FY21. In contrast, market share of proprietary traders has gradually declined in terms of overall index futures notional turnover by three percentage points from 31% in FY16 to 29% in FY21, followed by corporates, whose share has declined by six percentage points from 14% to 8% over the same period.

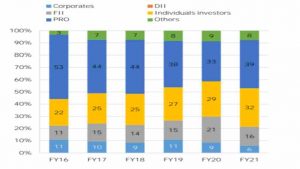

A similar trend was seen in Index options share of proprietary traders in Index options declined nearly 14 percentage points from 53% of the total premium turnover in FY16 to 39% in FY21, they hold the largest share in index options premium turnover as on date. The fall in the market share of prop traders was largely offset by a significant rise (10 percentage points) in the share of individual investors from 22% to 32% over the same period. Among other clients, the share of Corporate declined nearly five percentage points from 11% to 6% over the period whereas FII’s shares increased from 11% to 16%.

Analysing the numbers Deepak Shenoy, Founder and CEO of Capital Mind, said: “Most of these individual investors are HNIs and have probably learnt over long periods of time, how to make and lose money in this business.”

Many experts are of the view that a change in rules by SEBI to pay upfront margin even for simple buying and selling of stock may have forced some to switch to F&O segments. This, coupled with weekly expiry, makes the F&O segment more lucrative for investors.

“Robust client addition and market volatility are key factors for surging volumes, largely led by options. Recent SEBI norms regarding peak margin are likely to impact volumes in the near term as upfront margin requirement will gradually rise to 100% from September 2021 onwards,” ICICI Direct said in a report.

F&O — risky for many

We all have heard that investing in the stock market is risky and if our strategy is not right, one stands to lose a lot of money. That’s exactly why most Indians don’t consider investing in equities. Similarly, Future and Options trading is 10 times riskier than equity as they are a contract-bound trading type where the trade is carried out on the underlying asset, which is either a stock or an index.

Warren Buffett calls F&O trading the financial instruments of mass destruction.

The biggest drawback of Future and Options trading is that it allows you to take a leverage position, which is why one can make humongous profits as well as incur massive losses

“If you don’t understand it, don’t trade it. Don’t do it unless you can devote lots of time to learn and grow,” said Shenoy.