Record IPOs and market tops: Will it lead to the stock market crash?

In 2021 to date, 38 new IPOs have hit the market and another 20-25 are scheduled to make their debut.

On the morning of January 15, 2008, serpentine queues formed at every brokerage office with the line growing every hour. These lines were for one of India’s blockbuster IPOs, Reliance Power. Hopes were high. A line from one of IMDb’s highest-rated movies, The Shawshank Redemption, says “Hope is a good thing, maybe the best of the things. And a good thing never dies.”

However, a William O’Neil quote says “Personal opinions, feelings, hopes, and beliefs about the stock market are usually wrong and often dangerous. Facts and markets, on the other hand, are seldom wrong.”

The application scenario during the Reliance’ IPO was different. An IPO would take three to four weeks to be listed. For example, the Reliance Power IPO was open from January 15 to January 18, 2008 and was listed on February 11. The new investors of today might be unaware about the process of filling out forms, issuing checks, seeing amounts debited, and even credited back, if not allotted – and all of these are conducted offline.

The current application supported by the blocked amount (ASBA) system has improved efficiency manifold. The entire process is completed within a week and the amount is not debited unless the investor receives an allotment. IPOs in 2020 started in March, with SBI Card swiping in the primary market. Around the same time, the Covid-19 pandemic triggered the worst selloff in equity markets in more than a decade.

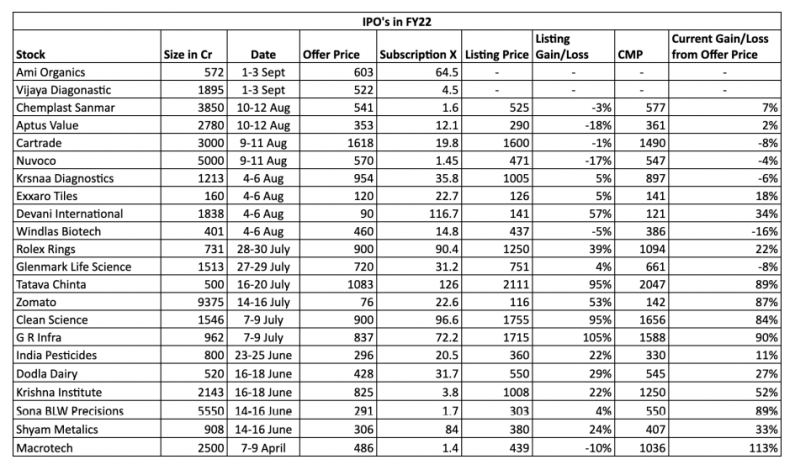

With a V-shaped recovery in the market, major companies launched IPOs in Q2 FY21 to raise funds, which received a robust response from investors. A few were subscribed 150 times and more. About 16 IPOs in 2020 set a base for more to come. In 2021 to date, 38 new IPOs have hit the market and another 20-25 are scheduled to make their debut. With the current frenzy around IPOs, there is concern that the market is heading to a crash.

Will the current IPO frenzy lead to a crash?

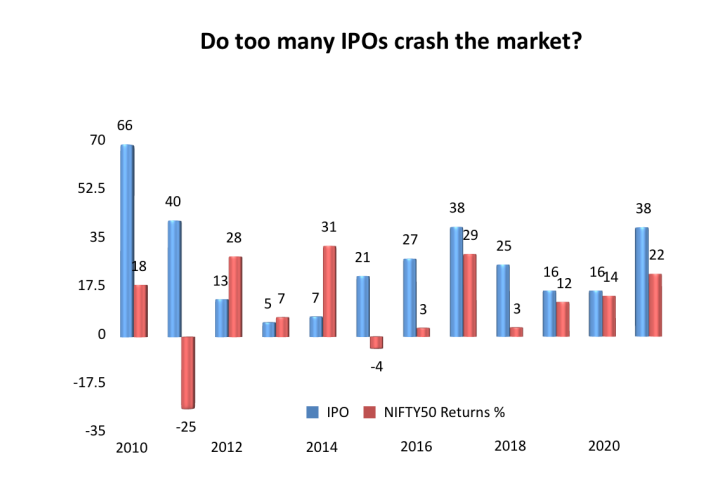

In the first eight months of 2021, 38 companies have filed for IPOs, with the cumulative issue size of these being estimated at Rs 62,763 crore. According to William O’Neil India, it is a common perception that too many IPOs will crash the market as liquidity is diverted from secondary markets to the primary markets.

However, after the Covid-19 outbreak, central banks worldwide have been lowering interest rates and purchasing assets to alleviate the liquidity crunch in the market. Following cues from the global central banks, the Reserve Bank of India (RBI) too lowered interest rates, to support the economy. However, during the pandemic, many small businesses shut down due to lockdowns, which prompts people to find alternate sources of income.

There is where the stock market benefitted. The number of Demat accounts opened between December 2019 and August 2021 has gone up by more than 70% to 6.9 crore. This has also brought liquidity pouring into IPOs.

“Apart from the 2008 IPO frenzy and the subsequent market crash, there is only one instance that depicts an instance when too many IPOs have led to a market crash. In 2010, 66 companies came up with IPOs and the market rallied by 18% that year. However, Nifty50 corrected by 25% the following year,” William O’Neil India said in a report.

Download Money9 App for the latest updates on Personal Finance.

Related

- SEBI ने NSDL को IPO लाने के लिए 31 जुलाई तक का समय दिया

- EWFL Restructures Stock as Industry Soars

- इंडसइंड बैंक का शेयर 23 फीसदी टूटा, 52 सप्ताह के निचले स्तर पर

- एशियाई बाजारों में तेजी के बीच सेंसेक्स 564 अंक चढ़ा

- अशोक लेलैंड की कुल बिक्री फरवरी में दो प्रतिशत बढ़ी

- टॉप से रिवर्स गियर में कैसे आ गई टाटा मोटर्स, एक्सप्रेसवे से कुछ यूं उतरी कंपनी, क्या अब आने वाले हैं अच्छे दिन?