Sensex falls 78 points, Nifty ends below 17,550; HDFC twins top drags

The BSE Sensex closed 77.94 points or 0.13% lower at 58,927.33, while the NSE Nifty ended at 17,546.65, down 15.35 points or 0.09%

Domestic equity benchmarks ended in the red on Tuesday, dhead of the US Fed meeting outcome. The BSE Sensex closed 77.94 points or 0.13% lower at 58,927.33, while the NSE Nifty ended at 17,546.65, down 15.35 points or 0.09%. On the other hand, broader markets ended with strong gains.

Shares of Zee Entertainment (ZEEL) surged 30.50% after the media company’s board unanimously provided an in-principle approval for the merger between Sony Pictures Networks India (SPNI) & ZEEL.

“Despite hopeful signs in the global markets, domestic main indices traded in a narrow range to give away its early gains in today’s volatile session. However, the broad market was robust barring banks, all major sectors were in demand and media, metals and realty outperformed. Realty stocks were in focus owing to an increase in property registrations in September while easing jitters over the Chinese economy bolstered metal stocks. Investors traded cautiously awaiting the outcome of the FOMC meeting that will clear the air regarding Fed’s tapering plans,” said Vinod Nair, Head of Research at Geojit Financial Services.

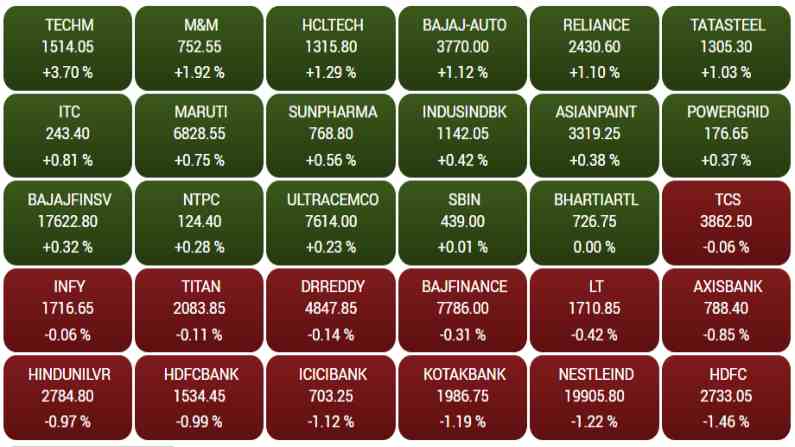

Gainers & losers

Top gainers & losers on the Sensex.

Sectoral stand

Most sectoral indices on the NSE closed in the green. Nifty Media, surging over 15%, was the top sectoral gainer mainly led by the over 30% rally in ZEEL. Nifty IT Nifty Auto settled above 1% each. Nifty Pharma advanced 0.62%. On the downside, Nifty Bank lost 0.61% and Nifty FMCG was down 0.17%.

Broader market

Unlike benchmark indices, the broader market ended with strong gains. The BSE MidCap index rallied 374 points or 1.51% to 24,792 whereas the BSE SmallCap index advanced 1.19% or 326 points 27,856.

Bulls outpowered bears in today’s session as 2,098 shares advanced compared 1,140 declined and 165 remained unchanged on the BSE.

Economy

The Asian Development Bank on Wednesday revised down India’s economic growth forecast for the current fiscal to 10%, from 11% predicted earlier, citing the adverse impact of the second wave of the pandemic.

The outbreak, however, dissipated faster than anticipated, resulting in several states easing lockdown measures and returning to more normal travel patterns. The economy is expected to rebound strongly in the remaining three quarters of FY2021, and grow by 10% in the full fiscal year before moderating to 7.5% in FY2022, said the Asian Development Outlook Update (ADOU) 2021.

Global markets

European markets and most Asian stocks continued to trade higher on Wednesday, 22 September 2021. Markets in Hong Kong are closed for a holiday. Investors continued to assess the debt crisis at China Evergrande Group and gird for a Federal Reserve meeting that is expected to signal a timetable for the reduction in stimulus later this year.

Property company Evergrande, which has more than $300 billion of liabilities, missed some interest payments due Monday and investors are seeking clues about how Beijing plans to deal with the cash crunch.