SGX Nifty indicates a negative opening for Indian indices

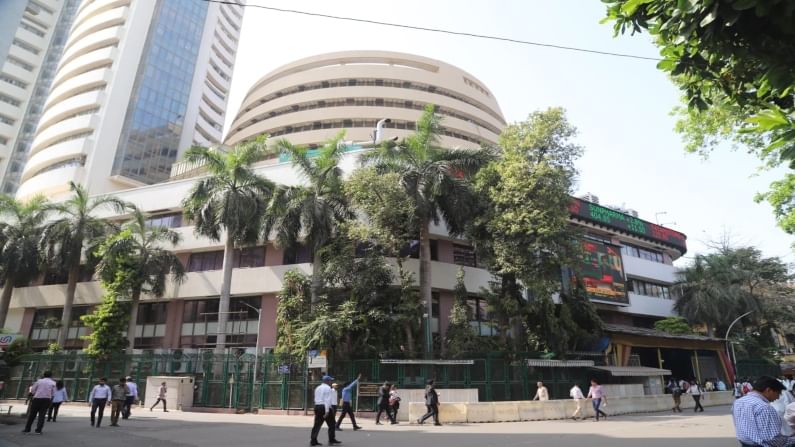

Key equity indices BSE Sensex and NSE Nifty ended flat after a volatile trade on Wednesday, tracking negative global cues.

Trading of Nifty 50 index futures on the Singapore stock exchange indicates that the Nifty could fall 45 points at the opening bell. Overseas, Asian stocks traded lower on Thursday as investors continue to fret over a slowdown in the recovery from the pandemic. China’s consumer price index rose 0.8% year-on-year in August. Meanwhile, the producer price index jumped 9.5% from a year ago.

Wall Street ended lower on Wednesday, spooked by worries that the Delta coronavirus variant could blunt the economy’s recovery and on uncertainty about when the US Federal Reserve may pull back its accommodative policies.

Meanwhile, the Federal Reserve said in its latest “Beige Book” that US businesses are experiencing rising inflation that is being intensified by a shortage of goods and likely will be passed onto consumers in many areas.

The Fed also reported that growth overall had “downshifted slightly to a moderate pace” amid rising public health concerns during the July through August period that the report covers.

“The deceleration in economic activity was largely attributable to a pullback in dining out, travel, and tourism in most Districts, reflecting safety concerns due to the rise of the Delta variant, and, in a few cases, international travel restrictions,” the report said.

Domestic markets: Back home, key equity indices ended flat after a volatile trade on Wednesday, tracking negative global cues. The S&P BSE Sensex, dropped 29.22 points or 0.05% at 58,250.26. The Nifty 50 index fell 8.6 points or 0.05% to end at 17,353.50.

Foreign portfolio investors (FPIs) sold shares worth Rs 802.51 crore, while domestic institutional investors (DIIs), were net buyers to the tune of Rs 0.60 crore in the Indian equity market on 8 September, provisional data showed.

Download Money9 App for the latest updates on Personal Finance.

Related

- देश का विदेशी मुद्रा भंडार 4.47 अरब डॉलर घटकर 688.1 अरब डॉलर पर

- मौद्रिक नीति पर निर्णय से पहले सेंसेक्स 308 अंक टूटा, निफ्टी भी नुकसान में

- जी एंटरटेनमेंट के शेयरधारकों ने प्रवर्तक संस्थाओं से 2,237.44 करोड़ जुटाने के प्रस्ताव को किया खारिज

- 15 जुलाई तक मक्का, धान की फसलों का बीमा कराएं किसान: हमीरपुर जिला अधिकारी

- सेंसेक्स की शीर्ष 10 कंपनियों में से नौ का बाजार पूंजीकरण 2.34 लाख करोड़ रुपये बढ़ा

- नेस्ले इंडिया के निदेशक मंडल के 1:1 बोनस शेयर जारी करने को दी मंजूरी दी