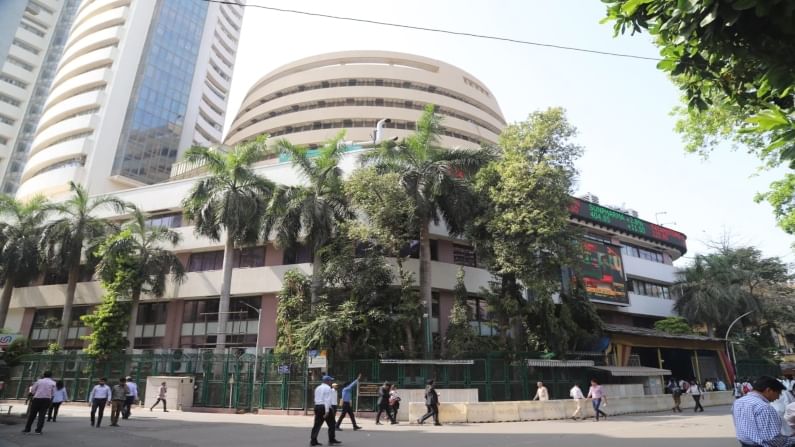

SGX Nifty indicates negative opening for Indian markets

Asian stocks traded mixed on Thursday, as US markets again surged to record highs. Meanwhile, South Korea's central bank hiked interest rates.

Trading of Nifty 50 index futures on the Singapore stock exchange indicates that the Nifty could fall 9 points at the opening bell. Overseas, Asian stocks traded mixed on Thursday, as US markets again surged to record highs. Meanwhile, South Korea’s central bank hiked interest rates.

South Korea’s central bank raised its policy rate on Thursday, becoming the first major Asian economy to do so in the pandemic amid concerns record-low monetary settings are overheating demand. The Bank of Korea’s monetary policy board raised the benchmark interest rate by 25 basis points to 0.75%.

Wall Street gained ground on Wednesday, with chipmakers and financials helping to push the S&P 500 and the Nasdaq to record closing highs as investors look to the upcoming Jackson Hole Symposium.

The highly anticipated Jackson Hole symposium kicks off Thursday, and central bankers may provide updates on their plan around tapering monetary stimulus. The Federal Reserve has been purchasing at least $120 billion of bonds per month to curb longer-term interest rates and jumpstart economic growth as the pandemic wreaked havoc on the economy. Chairman Jerome Powell is slated to make remarks on Friday.

Johnson & Johnson said on Wednesday that its Covid Vaccine booster shot showed promising results in early stage clinical trials, significantly increasing virus-fighting antibodies.

Domestic markets:

Back home, after hitting record-high levels in intraday trade, the benchmark indices sharply pared gains and ended near the flat line on Wednesday. The barometer index, the S&P BSE Sensex, slipped 14.77 points or 0.03% to 55,944.21. The Nifty 50 index added 10.05 points or 0.06% to 16,634.65.

Foreign portfolio investors (FPIs) sold shares worth Rs 1,071.83 crore, while domestic institutional investors (DIIs), were net sellers to the tune of Rs 151.39 crore in the Indian equity market on 25 August, provisional data showed.