Looking for income stocks? Here are top 12 highest dividend paying companies in India

At least 18 stocks provide a dividend yield of more than 6%. Out of the top 50 dividend yield companies, 20 stocks comes from the PSU category

While the benchmark equity indices BSE Sensex and NSE Nifty are at their lifetime high levels, select investors on the other hand must be zeroing on high dividend yield stocks as they provide a margin of safety and stable growth over a period of time.

The dividend yield is calculated by dividing the dividend declared for a financial year by the stock’s market price. These stocks are also known as income stocks as companies with high dividend yield distribute a substantial portion of profit among shareholders. A high dividend-paying company also means that they are less risky and offer consistent growth along with logging large cash in their books.

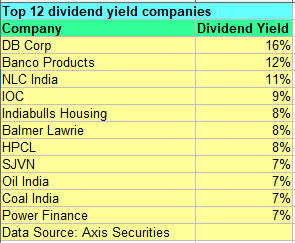

According to a report by Axis Securities, DB Corp enjoys the highest dividend yield of 16%. It was followed by Banco Products (12%), NLC India (11%) and Indian Oil Corporation (9%).

Indiabulls Housing Finance, Balmer Lawrie, Hindustan Petroleum Corporation, SJVN, Oil India, Coal India, Power Finance Corporation, Indus Towers, REC and Laxmi Organic enjoys a dividend of between 7% and 8%.

Data shows that at least 18 stocks provide a dividend yield of more than 6%. Out of the top 50 dividend yield companies, 20 stocks comes from the PSU category.

Engineers India, RITES, Housing & Urban Development Corporation, NHPC, Power Grid Corporation of India and ONGC stood among other PSU stocks which have a dividend of the yield of between 4%-6%.

In general, a high dividend yield strategy can give a much better return to investors in a volatile market. According to market watchers, most of the dividend-paying stocks are consistent with their performance on most parameters including share price movement. That is why they form an important part of the portfolio especially at the time of high volatility.