These lenders may benefit from FM Nirmala Sitharaman’s relief package

Government will guarantee banks to lend to NBFC- MFIs for on-lending to their small microfinance borrowers

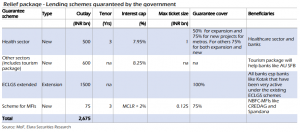

With an objective to revive the economy, the finance minister Nirmala Sitharaman on Monday introduced four new schemes where the government will offer guarantees of 50-100% to banks for lending to Covid impacted sectors. Analysts believe that these schemes will benefit stressed borrowers and the healthcare sector.

While the extended ECLGS scheme will result in lower stress in the short-term, it comes with tail risks because a large proportion of the beneficiaries of these schemes will be those that are facing stress and could default in the medium term. Only the additional funding is guaranteed by the government, not the base loan.

“The magnitude of tail risks of ECLGS will depend on the level of economic recovery in the next two years. In addition, the government proposes to infuse equity to the Export Credit Guarantee Corporation over 5 years to boost export insurance by Rs 88,000 crore. The new streamlined process for PPP projects and asset monetisation will help capex and reduce incremental project NPLs,” Elara Capital said.

Schemes and stocks

Healthcare sector: Under the scheme for the health sector with the total outlay of Rs 50,000 crore, bank loans with a ticket size of Rs 100 crore and a maximum interest rate of 7.95% will be guaranteed for 3 years. The guarantee cover for metros will be 50% for expansion and 75% for new projects, while for non-metros it will be 75% for both. “Complete healthcare sector and banks will benefit from the decision,” Elara Capital said. Elara Capital also has ‘Buy’ call on banking majors including HDFC Bank, ICICI Bank and SBI with a price target of Rs 1,860, Rs 720 and Rs 520, respectively.

Other sectors: Similarly there is a guarantee scheme for other sectors including tourism and travel. Sectors will be notified over time. Under the tourism scheme, a 100% guarantee will be provided for travel and tourism stakeholders recognized by the Ministry of Tourism up to a ticket size of Rs 1 million and tourist guides recognised by the Ministry of Tourism and state governments up to a ticket size of Rs 1,00,000.

Elara Capital believes that the move will benefit banks like AU Small Finance Bank that have a higher share of travel loans. Shares of AU Small Finance Bank traded 0.40% higher at Rs 1,054 at around 11.59 am (IST). On the other hand, the benchmark BSE Sensex was down 159 points, or 0.30%, at 52,576 at around the same time.

ECLGS: The existing ECLGS scheme has been extended to cover additional loans of Rs 1.5 lakh crore taking the total outlay to Rs 4.5 trillion. Under the new scheme, additional funds of more than 20% will be provided to eligible borrowers. In the previous ECLGS, additional funding was limited to 20%. Elara Capital believes that all banks will benefit from the decision especially Kotak Mahindra Bank that has been very active under the existing ECLGS schemes.

Scheme for MFIs: Government will guarantee banks to lend to NBFC- MFIs for on-lending to their small microfinance borrowers. Under this scheme, 2.5 million micro borrowers will be covered with a total outlay of Rs 7,500 crore. The maximum ticket size will be Rs 1,25,000. Elara Capital believes that the scheme will benefit NBFC-MFIs such as CreditAccess Grameen and Spandana Sphoorty. The total outlay of Rs 7500 crore under this scheme is equal to 3% of outstanding microloans given under the JLG model. Shares of CreditAccess Grameen were almost flat at Rs 750 in the afternoon trade, while Spandana Sphoorty traded 0.18% higher at Rs 673.

Download Money9 App for the latest updates on Personal Finance.

Related

- अमेरिका में लागत बढ़ने से भारत में माल भेज सकता है चीन, सरकार ने निगरानी प्रकोष्ठ बनाया

- जेनसोल इंजीनियरिंग और प्रमोटरों पर सेबी ने लगाया बैन, ये है मामला

- SEBI ने NSDL को IPO लाने के लिए 31 जुलाई तक का समय दिया

- EWFL Restructures Stock as Industry Soars

- इंडसइंड बैंक का शेयर 23 फीसदी टूटा, 52 सप्ताह के निचले स्तर पर

- एशियाई बाजारों में तेजी के बीच सेंसेक्स 564 अंक चढ़ा