Trading ideas: 6 stock recommendations for September 1, Wednesday

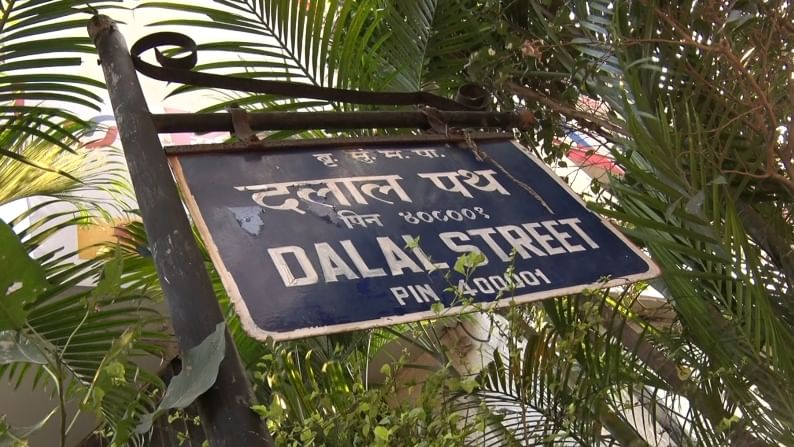

The Sensex climbed 57,500 mark for the first time ever on August 31, while the Nifty scaled 17,100 level.

Trading of Nifty50 index futures on the Singapore stock exchange indicates that the Nifty could open flat with negative bias on Wednesday. Earlier, domestic equity benchmarks hit record high levels for a second straight session on Tuesday, boosted by Bharti Airtel and Bajaj twins. Positive Asian cues also boosted sentiment. The Sensex climbed 57,500 mark for the first time ever while the Nifty scaled 17,100 level. Barring the Nifty Media index, all the sectoral indices on the NSE ended in the green.

The barometer index, the S&P BSE Sensex, soared 662.63 points or 1.16% at 57,552.39. The Nifty 50 index surged 201.15 points or 1.19% at 17,132.20. Both the indices attained record closing high levels. The Sensex hit a record high of 57,625.26 while the Nifty hit all-time high of 17,153.50 in late trade today.

Bharti Airtel (up 6.99%), Bajaj Finance (up 4.94%), Bajaj Finserv (up 3.34%), TCS (up 2.30%) and Tech Mahindra (up 1.97%) were major index movers.

The broader indices lagged the main stock indices. The BSE Mid-Cap index rose 0.83% and the BSE Small-Cap index gained 0.86%.

The market breadth was negative. On the BSE, 1,571 shares rose and 1,623 shares fell. A total of 147 shares were unchanged. Here are 6 money making ideas from technical analysts that may deliver decent returns in the near term.

Recommendations by: Milan Vaishnav, Gemstone Equity Research and Advisory

HDFC Bank | Buy | Target price: Rs 1,615 | Stop loss: Rs 1,565

Titan | Buy | Target price: Rs 1,960 | Stop loss: Rs 1,895

Larsen & Toubro | Buy | Target price: Rs 1,710 | Stop loss: Rs 1,655

Recommendations by: Mehul Kothari, Anand Rathi Shares and Stock Brokers

Canara Bank | Buy | Target price: Rs 170 | Stop loss: Rs 150

Glenmark | Buy | Target price: Rs 555 | Stop loss: Rs 515

Zee Entertainment | Buy | Target price: Rs 185 | Stop loss: Rs 169

Sebi’s Margin Rule:

Market regulator Securities and Exchange Board of India’s (SEBI) new margin rules will come into effect from Wednesday (1 September 2021). Under the new peak margin rule, traders will be required to give 100% margin upfront for their trades. As per the new peak margin norms, the margin requirements will be calculated four times during every trading session. It will also include intraday trading positions. The peak margin norms were introduced last year to curb speculative trading and restrict leverages offered by stockbrokers to their clients.

(Disclaimer: Stocks recommendations by experts or brokerages are their own and not those of the website or its management. Money9.com advises market participants to check with certified experts before taking any buy, sell or hold decisions)