Money-making opportunity: High frequency indicators in favour of these two sectors

Antique Stock Broking said: "Our analysis suggests that macro green shoots are visible in globally linked sectors like metals and IT services."

- Rahul Oberoi

- Last Updated : May 31, 2021, 17:14 IST

At least a dozen of high-frequency indicators suggest that the recovery in the global economy is much stronger than the domestic. Accordingly, market watchers see a strong macro tailwind in favour of export-oriented sectors like IT and metals.

Almost all the shares in these two sectors have already delivered a positive return to investors during the past one year. With a rally of 1,261%, Tanla Platforms emerged as the top gainer in the list. Shares of the company have jumped to Rs 917.40 on May 28, 2021, from Rs 67.40 on the same day last year.

Top gainers

Intellect Design Arena, Mastek, Subex, Ramco Systems and 3I Infotech have also gained over 460% during the same period. Metal majors like SAIL, JSW Steel and Tata Steel have advanced between 270%-305%. On the other hand, the benchmark BSE Sensex has gained nearly 60% during the same period.

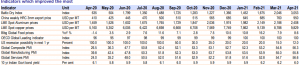

Antique Stock Broking said, “Our analysis suggests that macro green shoots are visible in globally linked sectors like metals and IT services. IT services macro has seen an improvement as indicated by robust global macros like US manufacturing PMI, US consumer confidence, and a further improvement in Eurozone/UK PMI data. Metals macro is also seeing steady improvement as evident from rising metal prices and improving Chinese demand. Chinese steel export prices and the Baltic Index continue to rise, providing an impetus to this sector.”

Most companies are confident of achieving double-digit revenue growth in FY22, with HCL Tech and Coforge explicitly guiding for this. TCS’ management has said it is on track to achieve a double-digit print in FY22. Bank of Baroda Capital Markets believes the uptick will be fuelled by a strong FY22 pipeline, record exit total contract value, a multiyear technology upcycle, and low base of FY21.

The brokerage is bullish on TCS (Target price: Rs 3,780), Infosys (Rs 1,540), HCL Technologies (Rs 1,190), Tech Mahindra (Rs 1,190), L&T Infotech (Rs 4,710) and Coforge (Rs 4,080).

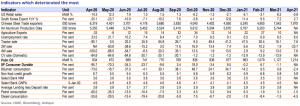

(Source: Antique Stock Broking)

On the other hand, Antique Stock Broking highlighted that macro pressure is clearly visible in consumption-liked sectors like FMCG, auto and cement.

FMCG sector macro has deteriorated because of weakness in consumer demand and elevated crude oil, palm oil and global food prices which may put some pressure on margin. Auto sector macro has also deteriorated as evident from the decline in domestic sales across segment like 2W, 4W and tractor amid rising uncertainty over Covid pandemic.

Commenting on the cement sector, Antique Stock Broking added that cement macro is not showing improvement because of weak cement demand due to weaker execution as labour availability is a challenge during the lockdown, which has resulted in flat cement prices on an MoM basis.

Commenting on the cement sector, Antique Stock Broking added that cement macro is not showing improvement because of weak cement demand due to weaker execution as labour availability is a challenge during the lockdown, which has resulted in flat cement prices on an MoM basis.

Download Money9 App for the latest updates on Personal Finance.

Related

- देश का विदेशी मुद्रा भंडार 4.47 अरब डॉलर घटकर 688.1 अरब डॉलर पर

- मौद्रिक नीति पर निर्णय से पहले सेंसेक्स 308 अंक टूटा, निफ्टी भी नुकसान में

- जी एंटरटेनमेंट के शेयरधारकों ने प्रवर्तक संस्थाओं से 2,237.44 करोड़ जुटाने के प्रस्ताव को किया खारिज

- 15 जुलाई तक मक्का, धान की फसलों का बीमा कराएं किसान: हमीरपुर जिला अधिकारी

- सेंसेक्स की शीर्ष 10 कंपनियों में से नौ का बाजार पूंजीकरण 2.34 लाख करोड़ रुपये बढ़ा

- नेस्ले इंडिया के निदेशक मंडल के 1:1 बोनस शेयर जारी करने को दी मंजूरी दी