Why Indian markets need 'Bad Bank'

The constitution of a ‘Bad Bank’ in our view is a positive development as the focus remains on the faster resolution of stressed assets

Sentiment on Dalal Street remains optimistic, given improving macro data points and positive earnings expectations. The PLI schemes announced by the government shows their strong intent to address the sectors’ challenges and pave way for the development of local capabilities and capacities, thus enabling companies to rightly capture the opportunity thrown open by the China+1 strategy. The constitution of a ‘Bad Bank’ in our view is a positive development as the focus remains on the faster resolution of stressed assets, which will improve the balance sheet of banks.

The upfront cash payment would also aid in providing incremental cash flows and will enable banks to focus more on their core operations. However, valuations are not comfortable and hence could lead to bouts of profit booking.

The weak global cues on account of worry over slower economic growth and rising Delta variant cases globally would market oscillating between greed and fear. Nervousness would be seen in the market next week ahead of the Federal Reserve meeting, which could provide some indications on when the central bank will start withdrawing its monetary stimulus and start raising interest rates eventually.

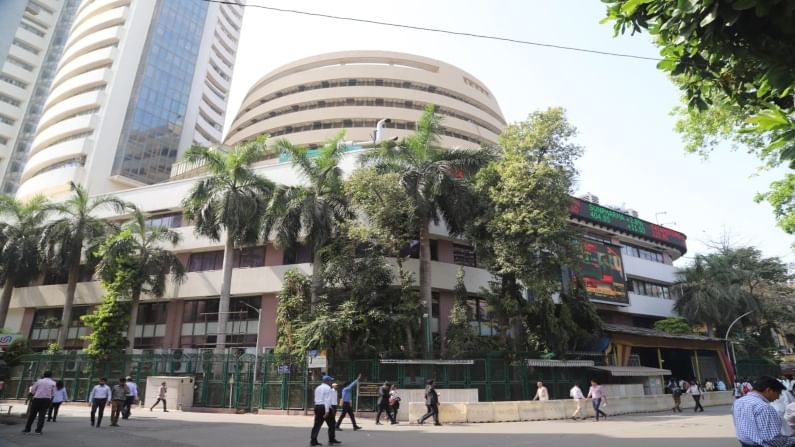

Overall, benchmark equity indices logged strong gains during the week as market sentiments improved after the central government’s announcement of multiple support measures. The Sensex and the Nifty, both, scaled record highs. The Nifty managed to close above the 17,500 mark while the Sensex ended above the 59,000 level.

For the week ended on Friday, 17 September 2021, the Sensex jumped 710.82 points or 1.22% to settle at 59,015.89. The Nifty 50 index gained 215.90 points or 1.24% to settle at 17,585.15. The BSE Mid-Cap index rose 341.19 or 1.38% to settle at 25,046.48. The BSE Small-Cap index added 361.69 points or 1.31% to settle at 28,006.79.

Earlier, equity benchmarks ended a volatile trading session with modest losses on Monday, 13 September 2021. The barometer index, the S&P BSE Sensex, was down 127.31 points or 0.22% at 58,177.76. The Nifty 50 index was down 13.95 points or 0.08% at 17,355.30. Key indices ended a volatile trading session with small gains on Tuesday, 14 September 2021. Gains were capped due to mixed global cues. The barometer index, the S&P BSE Sensex, rose 69.33 points or 0.12% at 58,247.09. The Nifty 50 index gained 24.70 points or 0.14% at 17,380.

The domestic equity benchmarks ended near the day’s high after a strong session on September 15. Cabinet approval for production linked incentives (PLI) for auto sector and relief measures for telecom sector boosted sentiments. The barometer index, the S&P BSE Sensex, surged 476.11 points or 0.82% to 58,723.20. The Nifty 50 index advanced 139.45 points or 0.80% to 17,519.45.

Benchmark indices ended with robust gains on Thursday, 16 September 2021. The rally is supported by various Production-Linked Incentive (PLI) schemes introduced by the government. Aggressive Covid-19 vaccination program in India and persistent foreign capital inflows added to the momentum. The barometer index, the S&P BSE Sensex, jumped 417.96 points or 0.71% at 59,141.16. The Nifty 50 index advanced 110.05 points or 0.63% to 17,629.50.

Stocks snapped a three-day winning run and ended a volatile trading session with small losses on September 17. The barometer index, the S&P BSE Sensex, fell 125.27 points or 0.21% at 59,015.89. The Nifty 50 index was down 44.35 points or 0.25% at 17,585.15. The Sensex hit a record high of 59,737.32 while the Nifty hit an all-time high of 17,792.95 in intraday trade.

(The writer is head-retail research, Motilal Oswal Financial Services; views expressed are personal)