Waiting for March 2024 to invest in ELSS for tax savings?

Equity Linked Savings Scheme, or ELSS, is a type of mutual fund investment that falls under the Equity category of mutual funds.

The Money9 India’s Personal Finance Pulse survey 2023, found that 10% of Indian families have now embraced mutual fund investments, up from 6% in 2022, showing a positive shift when it comes to the investment behaviour of households in terms of mutual funds.

Now consider a mutual fund that lowers your tax burden and opens the door to wealth accumulation. Enter ELSS, the Equity Linked Savings Scheme, where the thrill of the stock market meets the world of tax-saving investments. But let’s understand what they are and should you invest.

What is an equity-linked Savings Scheme?

Equity Linked Savings Scheme, or ELSS, is a type of mutual fund investment that falls under the Equity category of mutual funds. The fund manager invests at least 80% of the investment in stocks.

Compared to other tax-saving products like PPF (Public Provident Fund) with a 15-year lock-in period, tax-saving FD (Fixed Deposit), and NSC (National Savings Certificate) with a 5-year lock-in, ELSS stands out due to its relatively lower lock-in period of just three years, all while generating higher returns.

These funds are known for their diversification and historical track record of delivering favorable returns compared to other tax-saving options.

Investors may deduct up to Rs. 1.5 lakh from their taxable income in a financial year by investing in ELSS, which offers tax benefits under Section 80C of the Income-Tax Act.

ELSS has a mandatory lock-in period of three years. That means after three years, any gains of up to Rs 1 lakh a year are tax-free, and any gains over this limit will attract a long-term capital gains tax at 10% plus applicable cess and surcharge.

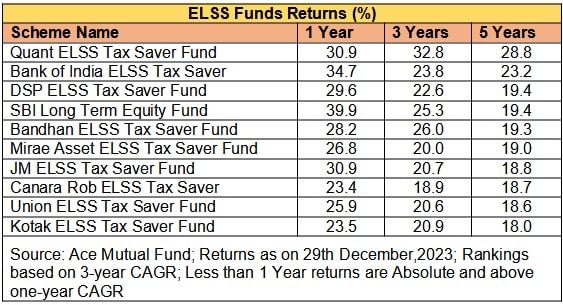

On average, as per Ace mutual fund data, the ELSS has given a return of 27%, 20%, and 16% over 1,3 and 5 years, respectively, as of 29 December 2023.

ELSS funds invest a substantial portion of their capital in stocks, making them susceptible to market fluctuations.

The value of equity investments can rise or fall based on economic conditions, corporate performance, global events, and investor sentiment, among other variables.

The NAV (Net Asset Value) of ELSS funds can be affected by market volatility, resulting in potential gains or losses for investors.

What is the right time to invest in ELSS?

Selecting a tax-saving option like ELSS shouldn’t be determined just by an investment’s historical performance or simply just for the tax saving purpose. It’s a more comprehensive choice, and investors should keep in mind the risk-return reward of ELSS as a product.

It’s crucial to remember that investors shouldn’t put off making an ELSS investment until the end of the fiscal year. The financial experts say that the investment in ELSS should be spread throughout the year either through systematic investment plans (SIPs) or if investors can buy whenever there is a window of market correction that is happening throughout the year.

Conclusion

Investors can invest in ELSS through systematic investment plans (SIPs), or even one can invest up to a lump sum amount.

Market experts have always stated that tax saving is a significant financial goal that requires careful planning.

Conversely, one should start investing in ELSS not before the end of the financial year but at the start of the financial year.