Does increase in SIP amount in December mean return of small investors?

- Rahul Oberoi

- Last Updated : January 23, 2021, 10:35 IST

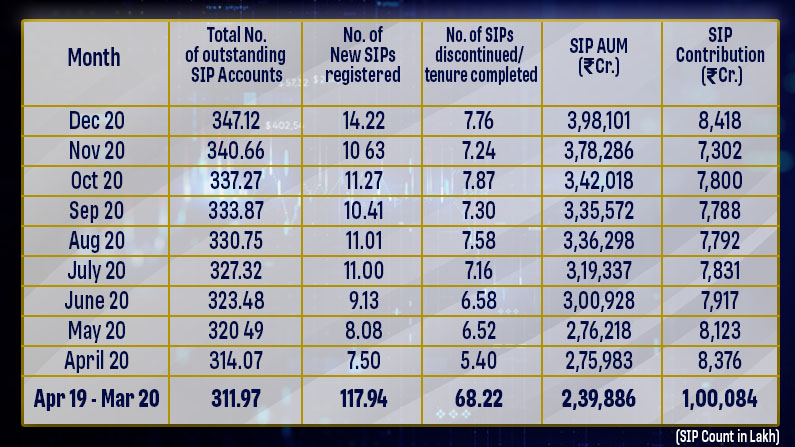

Investment in mutual funds through systematic investment plans (SIP) crossed Rs 8,000 crore in December for the first time since May 2020. The number of SIP folios also increased by 6.46 lakh on month-on-month (mom) basis to 3.47 crore. The assets under management (AUM) through SIPs grew by Rs 19,814 crore to Rs 3.98 lakh crore.

Investment in mutual funds through systematic investment plans (SIP) crossed Rs 8,000 crore in December for the first time since May 2020. The number of SIP folios also increased by 6.46 lakh on month-on-month (mom) basis to 3.47 crore. The assets under management (AUM) through SIPs grew by Rs 19,814 crore to Rs 3.98 lakh crore.

In December, 14.22 lakh SIPs got registered against 10.63 lakh in November, as per Association of Mutual Funds in India (Amfi) data. On the other hand, the number of discontinued SIPs increased to 7.76 lakh from 7.24 lakh.

The increased SIP amount indicates signs of improvement in the mutual fund industry. The sector has been facing outflows from equity funds amid the ongoing rally in the market.

Amfi data shows the SIP was Rs 8,418 crore in December against Rs 7,302 crore in November. The figure stood at Rs 7,800 crore, Rs 7,788 crore and Rs 7,792 crore in October, September and August, respectively. In the pre-Covid period, the figure stood above Rs 8,500 crore during December 2019 and March 2020.

Some market experts believe that SIP in December stood in line with previous months as the last three days of November 2020 were non-business days. Therefore, the contribution for December 2020 includes the SIP contribution that was due on those three days.

Amit Nanavati and Tanuj Kyal, research analysts, Nomura, in a report said, “While SIP flows for December did have some spill-over effect from November 20 (lesser working days), average SIP flows for November and December were at a run-rate similar to previous months at Rs 7,800-7,900 crore.

SIP is an investment plan offered by mutual funds wherein an investor can invest a fixed amount periodically. The SIP instalment amount could be as little as Rs 500 per month. SIP is similar to a recurring deposit where you deposit a small or fixed amount every month.

Overall, equity MFs witnessed a net outflow of Rs 10,147 crore in December against an outflow of Rs 12,917 crore in November, Amfi data shows.

Commenting on the data, NS Venkatesh, Chief Executive, AMFI said, “the all-time high AUM, increase in retail folios and SIP folios, is reflective of investor confidence in the mutual fund asset class. While net-inflows in equity and hybrid funds are negative, on the back of profit-led redemptions, the gross inflows are a healthy Rs 36,000 crore in these two categories.”

Download Money9 App for the latest updates on Personal Finance.

Related

- छोटे निवेश से भी करोड़पति बनना है आसान, ये फॉर्मूला अपना कर तो देखें

- मल्टीकैप फंडों ने मचाया धमाल, 1 साल में दिया 56 फीसदी तक का रिटर्न

- उतार-चढ़ाव वाले बाजार में भी फायदा, इस वैल्यू फंड में निफ्टी से ज्यादा फायदा

- बाजार की रफ्तार का उठाएं फायदा, मोमेंटम इंडेक्स फंड में निवेश का है माकूल वक्त

- एक साल में दिया 31 फीसदी तक का रिटर्न, इस बैलेंस्ड एडवांटेज फंड का रहा जलवा

- इस फंड ने 20 साल में 10 लाख का बना दिया 4.50 करोड़, निफ्टी से दोगुना दिया रिटर्न