ESG Funds have delivered over 50% return in just 1 year; should you invest?

ESG fund in India has been in existence for a short time but the track record has been good enough to merit a consideration in one’s portfolio

- Himali Patel

- Last Updated : June 9, 2021, 11:39 IST

The Covid-19 outbreak has not only compelled the companies to alter their business models but has also encouraged them to look beyond traditional remit. This entails investing in the Environmental, Social and Governance (ESG) practices. The mainstream about ESG has increased so much that the Securities and Exchange Board of India (SEBI), last month issued a circular regarding the format of Business Responsibility and Sustainability Report (“BRSR”).

This initiative will ensure investors make more informed decisions by identifying and assessing sustainability-related risks and opportunities of companies and make better investment decisions. ESG is an organised way of measuring company sustainability by identifying risks hidden under the business activities of a company. In a way, this is a positive screening for long-term sustainable businesses that also has an impact on the valuation of the company.

Earlier the traditional way of investing was more focused on analysing the prospects of an industry, and participant companies, for its potential to grow and the ability to make economic profits. The focus so far has been on growth, financials, governance, and valuations. However, with the new parameters set by SEBI, there is an expectation of growing acceptance amongst investors and corporates with regards to the importance of ESG parameters. Also, more and more investors are cognizant of the need to own businesses that are sustainable to continue compounding their wealth.

How does ESG Funds work? Today the trend of ESG analysis has become more mainstream, not just with dedicated funds but as a central approach to investing. The increase in the number of ESG-focused funds in India is testimony to the rising awareness amongst investors as more fund house managers are interested in identifying companies that have sustainable long-term prospects.

That said the ESG funds work just like any other mutual fund. However, the key differentiation being is the incorporation of ESG analysis in the research and investment decision-making process across different fund houses.

For the mutual fund manager, the investment strategy involves to invest in a basket of stocks after intensive analysis on the environment, social and governance aspects of the company. That said, the importance and contribution of each sector need to be appreciated and it’s important to find leaders in their industry that are truly well managed sustainable quality businesses.

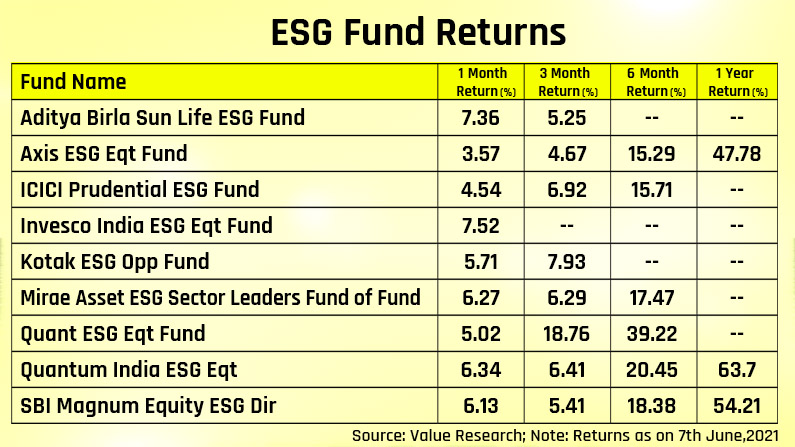

Performance report card ESG fund in India has been in existence for a short time but the track record has been good enough to merit a consideration in one’s portfolio. For instance, as per the value research data, under the equity-oriented mutual fund schemes the thematic ESG category funds has gone by 53.64% in the last one year as of 7th June, 2021. The second half of 2020 witnessed a launch of around 5 ESG funds.

Globally, mutual funds and asset managers have been seeking to embrace ESG (Environment, Social and Governance) evaluation into their investment framework. There is also a trend noticeable among global investors of evolving investor attitude towards responsible investing. As per the Morningstar report, Global inflows into sustainable funds were up 88% in the fourth quarter of 2020 to $152.3 billion, a record-breaking quarter in terms of flows, assets, and product launches.

Earlier investors were looking at businesses through the prism of ESG practices prior to the pandemic outbreak; moving forward, ESG would become a primary indicator of diligence when assessing a company’s profile or while choosing a fund for investment with greater scrutiny.

Download Money9 App for the latest updates on Personal Finance.

Related

- इक्विटी म्यूचुअल फंड में निवेश मई में 21.66 प्रतिशत घटकर 19,013 करोड़ रुपये

- जियो ब्लैकरॉक म्यूचुअल फंड ने शीर्ष स्तर पर अधिकारियों की नियुक्ति की

- बाजार के उतार-चढ़ाव में भी आब्रिट्राज फंडों ने दिया एफडी से ज्यादा रिटर्न

- इन 5 म्यूचुअल फंड्स ने 5 साल में दिया 20 फीसदी से ज्यादा का रिटर्न

- ये हैं टॉप 10 लार्ज कैप म्यूचुअल फंड, जिन्होंने दिया है 10 फीसदी से ज्यादा का रिटर्न

- ये हैं बंपर रिटर्न देने वाली टॉप म्यूचुअल फंड स्कीम, अकेले इस मिडकैप ने 12 महीने में दिया 57 फीसदी का मुनाफा