Have some extra funds? 3 places you can park them for decent returns

Investing in liquid funds is beneficial when the interest rates are on a rise, like till recently. However, these funds are not affected by any long-term changes in interest rates. Redemption in these funds is processed instantly, or just a day, in most cases.

Is your account flush with some extra funds this month? You want to invest them, but not lock them up for a long time? And moreover, you want them to stay liquid i.e. available as ready cash whenever you want. While the returns might not be very high, some short-term investment options can come in handy for you to park your funds for less than 12 months.

Says Sanjeev Dawar, Pune-based financial planner, “When it comes to parking funds for less than a year, high returns should be secondary. Primary objective has to be capital protection. Fixed income products are a preferred option here. Products which are market linked but very low in volatility are liquid funds and ultra short term funds. Investors can expect returns superior to FD with complete liquidity. There is no exit load if redeemed after a week. Partial or full withdrawal can happen in T+1 day”.

Let’s decode 3 of of these funds in detail:

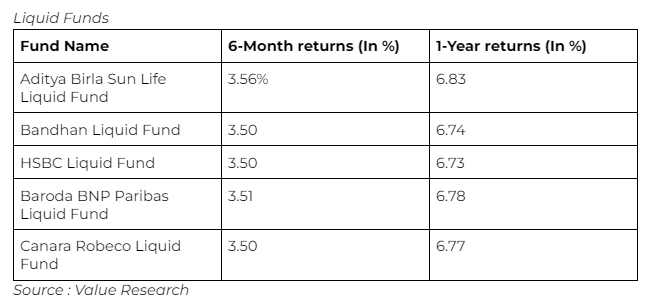

Liquid Funds

These debt funds invest in treasury bills, certificates of deposits and other securities with good credit history that mature within 91 days i.e. 3 months. They also hold at least 20% of all their assets in cash and cash like instruments, to meet instant payout demands.

Investing in liquid funds is beneficial when the interest rates are on a rise, like till recently. However, these funds are not affected by any long-term changes in such interest rates. Redemption in these funds is processed instantly, or just a day, in most cases.

Arbitrage Funds

Says Shifalee Satsangee, an Agra-based financial planner, “Arbitrage funds can also be considered apart from liquid and ultra short term funds for a short term time horizon since they are more tax efficient than debt funds”.

These funds, considered low-risk for investors, make money by simultaneously buying and selling in the derivatives and cash (spot) markets. Now, transactions are settled i.e. locked in immediately in spot markets, whereas they are promised or locked for a future date in the derivatives market. However, the price for this is determined today.

The difference in price levels in these two markets yields profits. Let’s understand this through an example. A fund purchased 500 shares, each worth Rs 50 in the spot market. The total here comes to Rs 25,000. At the same time, it sold these 500 shares in the futures market at Rs 60, which means the fund earned Rs 30,000. This means the fund gained Rs 5,000 in the whole transaction.

Now, in case the price of this share falls to Rs 40 in the spot market, you’d imagine the fund is in losses. But, if, at the same time, its prices rise in the derivatives market to Rs 70/share, the fund will still rake in profits. This is how arbitrage funds make the best of both markets, albeit with lesser liquidity than liquid funds.

Corporate Bond Funds

If you’re someone who prefers the safety of bank FDs and do not mind staying invested for 1-2 years, you can explore corporate bond funds as well. These debt funds lend only to financially strong companies that have a solid credit rating and are unlikely to default on repayments. Moreover, they tend to outperform bank FD returns in the medium duration.