Investors chase high returns as small, mid cap funds shine, but is it right approach?

While large-cap mutual funds, which invest 80% of their money in stable, blue-chip companies do not guarantee sky-high returns, they offer security and regularity of returns.

- Ira Puranik

- Last Updated : August 31, 2023, 18:40 IST

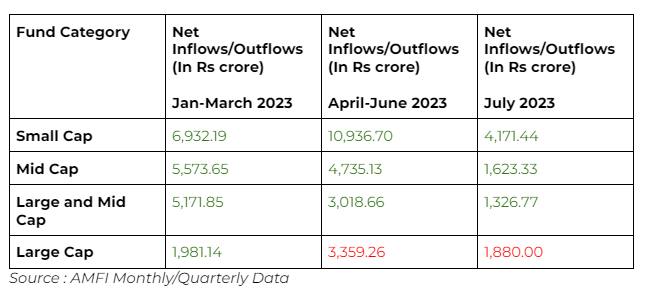

Large-cap funds have constantly been bleeding money for the past 4-5 months. On the other hand, small-cap and mid-cap funds have seen a consistent fund influx during the same period. In July 2023, investors withdrew Rs 1,880 crores from large-cap funds, while pouring in Rs 4,171.44 crores in small-cap, and about Rs 1,326 crores in large and mid-cap funds.

Table 1 : Net Inflows/Outflows in Mutual Funds, 2023

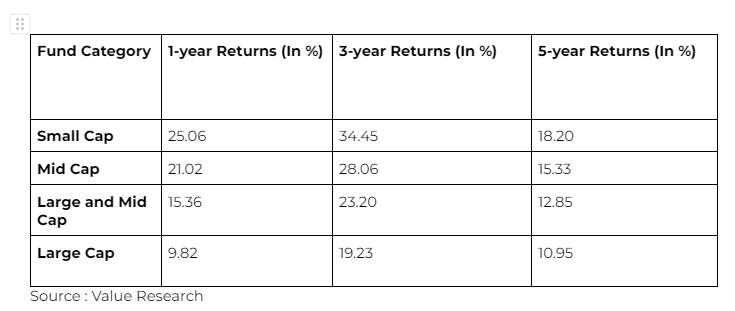

But why are large-cap funds losing their sheen? One reason could be their consistent underperformance over a one, three and five year period. For instance, over a 3-year period, large-cap funds have generated 19.23% returns. These fall significantly short of the benchmark (S&P BSE 100 Total Return Index) returns, which delivered 20.61% returns. Similarly, over a 5-year period, the index generated 12.06%, while large-cap funds only managed to deliver 10.95%.

Says CFA Kanika Shah, “Retail investors are currently attracted to the small and mid cap segments, which have given 25-35% in the last one year. Infact, even large cap funds have increased their exposure to both small and mid cap segments to boost their recent performance.”

Steady over-performance

Encouragingly, both mid-cap and small-cap funds have regularly been beating the benchmark returns. The S&P BSE Large Mid Cap Total Return Index has generated 21.01% returns over a 3-year period, and 12.15% over the last 5 years. But large and mid-cap mutual funds have easily outperformed this yardstick, delivering 23.20% and 12.85% returns over a 3 and 5-year period respectively.

Table 2 : Mutual Fund returns

But is this reason enough for you to shift your investments completely out of large-cap to just small and mid-cap mutual funds? No. Because while large-cap mutual funds, which invest 80% of their money in stable, blue-chip companies do not guarantee sky-high returns, they offer security and regularity of returns.

On the other hand, investments in small and mid-cap funds, as lucrative as they might be, are riddled with high risks and volatility. Notes financial planner Shifali Satsangee, “Investors leaving large-cap funds and flocking to small and mid cap funds is a clear case of behavioral biases of chasing winners”. Notably, many AMCs, like Tata and Nippon had restricted fresh inflows in its small-cap mutual fund schemes, owing to lack of viable investing opportunities a few months ago.

“While building a core portfolio, one should include large cap oriented index funds. Mid and small cap oriented funds should be part of investors peripheral portfolio. While the allure and glitter of high returns of mid and small cap funds is high, it is embedded with risks of over valuations and too much liquidity chasing too few stocks”, she continues.

And, as Shah also highlights, past performance is no indicator of how the funds are poised to perform in the times to come. “Unless the holding period of investors in small and mid cap funds is less than 5 years, investing in them simply for the sake of high returns might not be a viable option”.

Download Money9 App for the latest updates on Personal Finance.

Related

- बाजार के उतार-चढ़ाव में भी आब्रिट्राज फंडों ने दिया एफडी से ज्यादा रिटर्न

- इन 5 म्यूचुअल फंड्स ने 5 साल में दिया 20 फीसदी से ज्यादा का रिटर्न

- ये हैं टॉप 10 लार्ज कैप म्यूचुअल फंड, जिन्होंने दिया है 10 फीसदी से ज्यादा का रिटर्न

- ये हैं बंपर रिटर्न देने वाली टॉप म्यूचुअल फंड स्कीम, अकेले इस मिडकैप ने 12 महीने में दिया 57 फीसदी का मुनाफा

- कितने तरह के होते हैं ETF, आपके लिए क्या है बेहतर?

- ETF में पैसे लगाने के 4 बड़े फायदे, Investment से पहले जान लें ये बातें