Is Gold ETF’s appeal as haven and hedge against inflation expected to continue?

Investing in gold ETFs is equivalent to investing in stocks in the stock market. In contrast to physical gold, whose price varies by the state due to local taxes, gold ETFs reflect current gold prices.

- Himali Patel

- Last Updated : May 2, 2024, 19:56 IST

As per the Association of Mutual Funds in India (AMFI), net flows in Gold ETFs saw a sharp dip in March 2024, as the category garnered only Rs 373 crore, down from Rs 997 crore in February 2024.

However, despite the decline, this was still the twelfth consecutive month in which the category has continued to witness positive net inflows. Historically, investing in physical gold in the form of gold coins or jewelry has been the most popular option for consumers.

Although Gold prices are at an all-time high, with the advent of the digital era, a portion of the population also purchases digital gold, such as Gold exchange-traded funds (ETFs).

Understanding Gold ETFs:

Investing in gold ETFs is equivalent to investing in stocks in the stock market. In contrast to physical gold, whose price varies by the state due to local taxes, gold ETFs reflect current gold prices.

Investing in gold ETFs is possible through a Demat account. Investing in gold ETFs is the same as investing in gold with a purity of 99.5%.

Gold ETFs invest in gold bullion held electronically as mutual fund units kept in a dematerialized (demat) account. Further, like shares, this can be purchased and sold on the stock exchange and traded there.

Having said that, profits made on ETFs are taxed as per income tax slab regardless of when one sells them.

Returns:

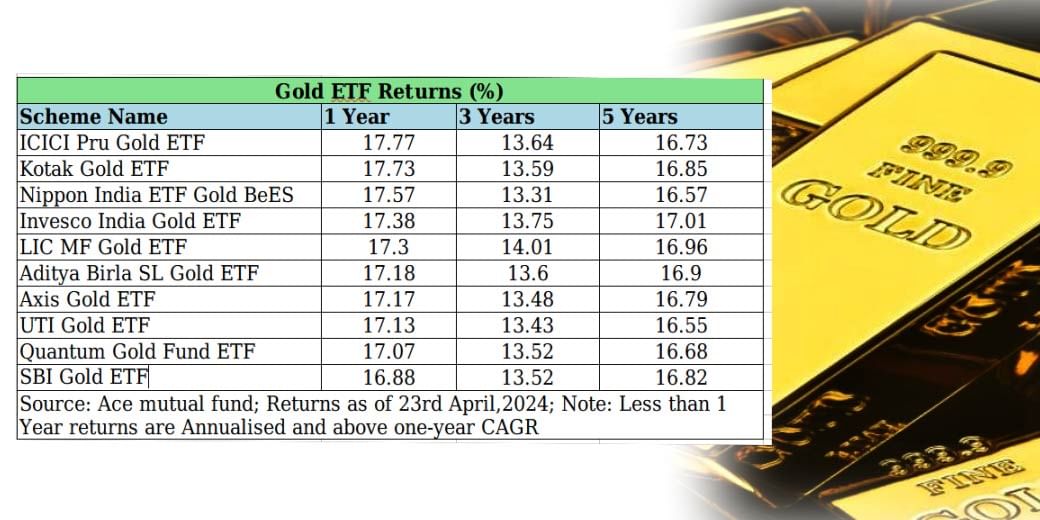

As per the Ace mutual fund, the average return delivered by the Gold ETF over 1,3, and 5 years have been 17.30%, 13.55%, and 16.76% respectively as of 23rd April, 2024.

Scheme-wise ICICI Pru Gold ETF has given returns of 17.77%,13.64%, and 16.73% respectively over the same period. Meanwhile, Kotak Gold ETF has delivered a return of 17.73%, 13.59% and 16.85% respectively.

What should investors do?

Every financial goal should be followed by an appropriate asset allocation. The most important ground rule is to follow an asset allocation approach by diversifying investments across various asset classes, such as equity, debt, and gold.

According to financial experts, not more than 10% of your asset allocation should be in gold. Investors must also be aware that these funds can’t consistently provide higher returns as they can only provide a cushion during economic uncertainty.

So will the trend continue going forward?

“With ongoing geopolitical tensions, US inflation is still higher than the desired number, and the appeal of Gold as a haven and hedge against inflation is expected to continue. Some investors could be choosing to opt for a risk-on approach to investing with the anticipation of a reversal in the rate cycle going ahead,” explains Melvyn Santarita, Analyst, Morningstar Investment Research India Private Limited.

Conclusion:

Today, Gold ETFs continue to be a good avenue for investors to invest in gold. Given its history of being a good hedge against inflation and global uncertainty, investors could consider investing only a small percentage of their allocation into gold.

However, it is always advisable for investors to note gold price differences whenever they are investing in any form of digital gold, as there is always a minor difference in prices on various platforms as; sometimes, they are inclusive of brokerage charges, storage charges, etc.

Further, investing in Gold ETFs again depends on investors’ short—and long-term goals, risk appetite, and general understanding of gold. If the investor is unclear about where to invest, a financial advisor should be consulted.

Download Money9 App for the latest updates on Personal Finance.

Related

- इक्विटी म्यूचुअल फंड में निवेश मई में 21.66 प्रतिशत घटकर 19,013 करोड़ रुपये

- जियो ब्लैकरॉक म्यूचुअल फंड ने शीर्ष स्तर पर अधिकारियों की नियुक्ति की

- बाजार के उतार-चढ़ाव में भी आब्रिट्राज फंडों ने दिया एफडी से ज्यादा रिटर्न

- इन 5 म्यूचुअल फंड्स ने 5 साल में दिया 20 फीसदी से ज्यादा का रिटर्न

- ये हैं टॉप 10 लार्ज कैप म्यूचुअल फंड, जिन्होंने दिया है 10 फीसदी से ज्यादा का रिटर्न

- ये हैं बंपर रिटर्न देने वाली टॉप म्यूचुअल फंड स्कीम, अकेले इस मिडकैप ने 12 महीने में दिया 57 फीसदी का मुनाफा