Mutual Funds get over 20 lakh new investors in FY21

The mutual fund industry witnessed nearly double-digit growth in terms of the number of unique investors across schemes during the previous financial year ended March 31

- Rahul Oberoi

- Last Updated : April 14, 2021, 13:00 IST

The mutual fund industry witnessed nearly double-digit growth in terms of the number of unique investors across schemes during the previous financial year ended March 31. Overall, market sentiment remained buoyed on Dalal Street last fiscal on the back of sustained inflows by foreign institutional investors and liquidity measures taken by the central bank and government to aid the ailing economy from the Covid pandemic.

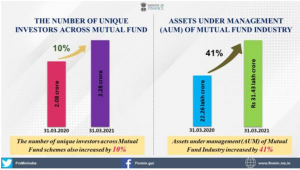

Benchmark equity indices BSE Sensex and NSE Nifty rallied 68% and 70% during April 1, 2020-March 31, 2021. Data released by the Ministry of Finance showed that the total investors increased by 10%, or 20 lakh, to 2.28 crore in FY21 from 2.08 crore as of March 31, 2020.

“Indian capital market has shown its resilience to withstand the ripples caused by exogenous shocks like the pandemic. Assets under management (AUM) of Mutual Fund Industry increased by 41% from Rs 22.26 lakh crore as of March 31, 2020 to Rs 31.43 lakh crore as of March 31, 2021,” the release said.

With the increasing expansion of the mutual fund industry in smaller cities, the asset under management (AUM) from below top 30 cities increased by 54% from Rs 3,48,167 crore as on March 31, 2020 to Rs 5,35,373 crore as on March 31, 2021, Ministry of Finance said, adding investors in mutual fund industry may choose to invest in any of the 1,735 schemes across categories as per their investment objective as on March 31, 2021.

Figures shared by the Association of Mutual Funds in India (Amfi) last week highlighted that equity funds also benefitted from continued inflows through systematic investment plans, getting net flows of Rs 96,080 crore in fiscal 2021 compared to Rs 1 lakh crore of inflows in the previous fiscal.

AMFI Chief Executive NS Venkatesh said, “It is indeed heartening that pandemic-impacted fiscal 2020-21 has ended on a positive healthy note with mutual fund industry AAUMs at historic high at Rs 32.17 lakh crore as on March 31, 2021. Mutual funds continue to be preferred investment vehicle to build long term goal-based wealth creation, as is reflected from the number of unique investors across mutual fund schemes increasing in the last one year.”

In fiscal 2021, corporate bond funds, which invest in an underlying portfolio of top-rated papers, emerged as the biggest attraction with net inflows of Rs 69,305 crore. On the contrary, credit risk funds saw the highest net outflows of Rs 28,923 crore.

Sectoral or thematic funds recorded the highest net inflows of Rs 9,801 crore in FY21, while large-cap funds saw the highest net outflows of Rs 10,587 crore, as investors fretted about costly valuation after the recent sharp run-up in the market.

Download Money9 App for the latest updates on Personal Finance.

Related

- छोटे निवेश से भी करोड़पति बनना है आसान, ये फॉर्मूला अपना कर तो देखें

- मल्टीकैप फंडों ने मचाया धमाल, 1 साल में दिया 56 फीसदी तक का रिटर्न

- उतार-चढ़ाव वाले बाजार में भी फायदा, इस वैल्यू फंड में निफ्टी से ज्यादा फायदा

- बाजार की रफ्तार का उठाएं फायदा, मोमेंटम इंडेक्स फंड में निवेश का है माकूल वक्त

- एक साल में दिया 31 फीसदी तक का रिटर्न, इस बैलेंस्ड एडवांटेज फंड का रहा जलवा

- इस फंड ने 20 साल में 10 लाख का बना दिया 4.50 करोड़, निफ्टी से दोगुना दिया रिटर्न