-

Large cap funds continue to bleed, shows AMFI data

-

Should one invest in Consumption Mutual Funds?

Consumption stocks are expected to perform well this festive!

-

Is Every MF A Star Performer!

-

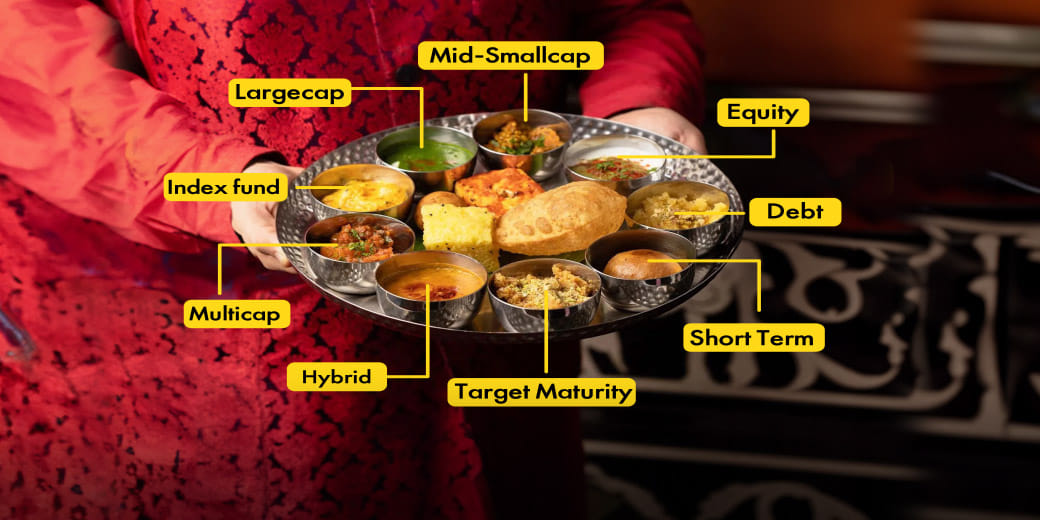

The Mutual Fund Menu!

-

Participate in IT sector’s growth with IT ETFs

-

Identify your risk through risk-o-meter

-

Debt Mutual Fund- A stable and Steady investment choice

-

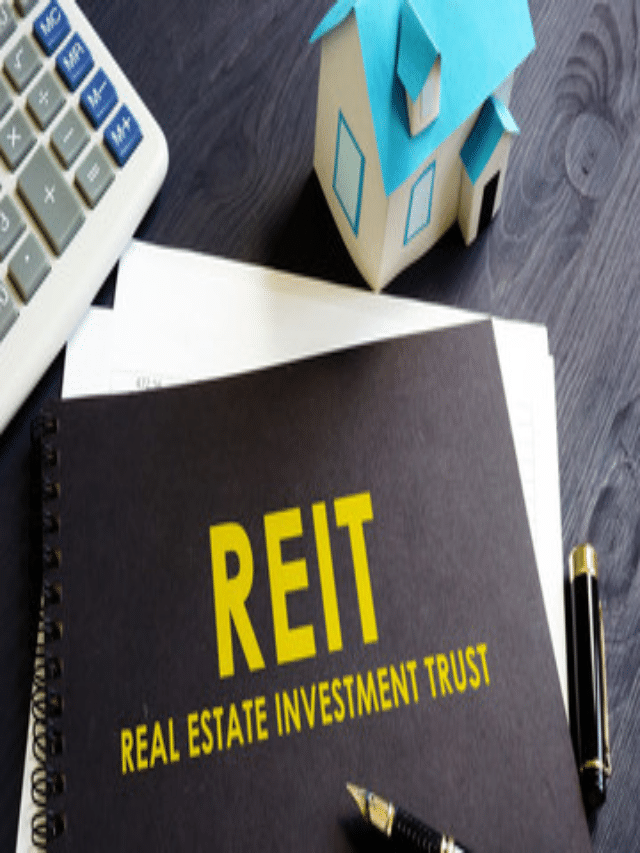

SEBI has new plans for REITs, InVITs unitholders

-

Advantages of investing in flexi cap funds

-

Where do fund mangers invest their money?